-

Lending and managing money for recording artists and labels can be a profitable niche. But volatile income streams, intellectual property challenges and business model upheaval can trip up the inexperienced.

June 7 -

Credit union will switch core processors in October, becoming the 21st Share One client in California.

May 31 -

The company was set to sell a 24% stake in itself to buy two Tennessee banks but has restructured the arrangement to avoid a potential conflict cited by a regulator.

May 30 -

The Tennessee bank has agreed to pay nearly $85 million for Capstone Bancshares in Alabama.

May 23 -

First Horizon CEO Bryan Jordan explains why he thinks policymakers will change the $50 billion asset cutoff and justify the regional bank's big acquisition.

May 4 -

The acquisition will make the Tennessee company one of the biggest banks in the Southeast, with assets of more than $40 billion.

May 4 -

The new name reflects the seven cooperative principles, including cooperation among cooperatives.

May 2 -

Christy Romero, the special inspector general for the Troubled Asset Relief Program, and two other government entities were involved in a probe that led Lamar Cox, former chief operating officer at Tennessee Commerce Bank, to plead guilty to misleading the FDIC.

April 25 -

The company has hired an investment bank to help it consider strategic alternatives, which could also include recapitalizing.

April 20 -

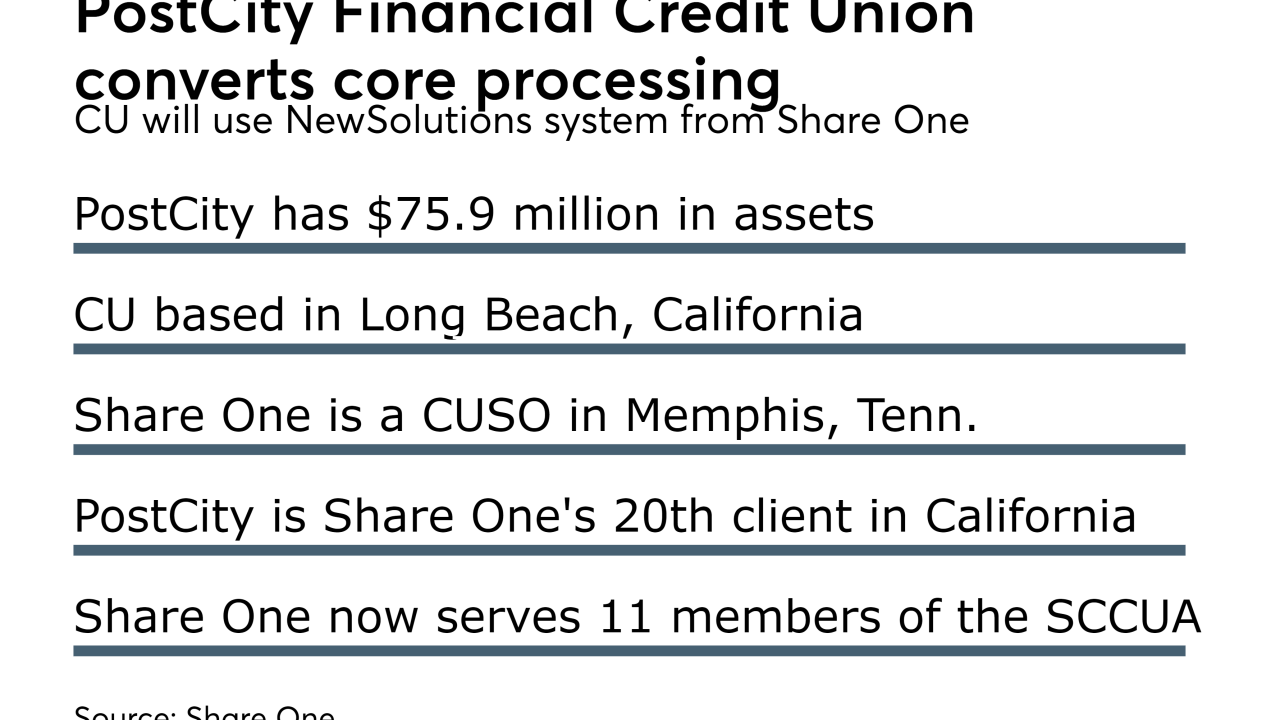

Credit union will switch May 1, becoming the 20th Share One client in California.

April 18 -

The Memphis, Tenn., company also reported an improvement in credit quality during the first quarter.

April 13 -

These execs say they are finding ways to reduce fixed costs in areas such as branching and personnel, offer appealing tech, yet provide in-person services when customers have concerns.

April 11 -

The Tennessee company has been working to resolve a memorandum of understanding tied to its CRE exposure.

April 4 -

Pinnacle Financial wanted to be in high-growth markets. BNC Bancorp saw more regulatory burden looming and limited opportunities to sell itself. Those factors spurred what is currently the year's second-biggest bank deal.

March 10 -

Bankers oppose legislation that would let local governments finance energy efficiency projects with liens ahead of the mortgage.

March 6 -

Commerce Union had been focused on expanding around Nashville, Tenn., until a lender based 120 miles away was available to hire.

February 27 -

DeVan Ard will succeed William DeBerry when DeBerry retires in June.

January 30 -

The $1.9 billion deal – the industry's largest announced in 2017 – will create a bank with nearly $20 billion in assets.

January 23 -

About $12 million of the proceeds will go toward exiting the Small Business Lending Fund.

January 18 -

The company would prefer buying banks with $5 billion to $10 billion in assets unless it finds an appealing alternative in a strategic market such as Raleigh or Nashville.

January 13