-

Bank of Austin still needs approval from the Federal Deposit Insurance Corp., though organizers remain hopeful it can open this summer.

May 9 -

The post-election rally in banking stocks has given certain buyers the ability to make acquisitions that would add to tangible book value, perhaps making it easier for them to pursue more deals.

May 8 -

The $71 million transaction is the latest in a series of acquisitions by Seacoast in recent months.

May 5 -

First Horizon CEO Bryan Jordan explains why he thinks policymakers will change the $50 billion asset cutoff and justify the regional bank's big acquisition.

May 4 -

The acquisition will make the Tennessee company one of the biggest banks in the Southeast, with assets of more than $40 billion.

May 4 -

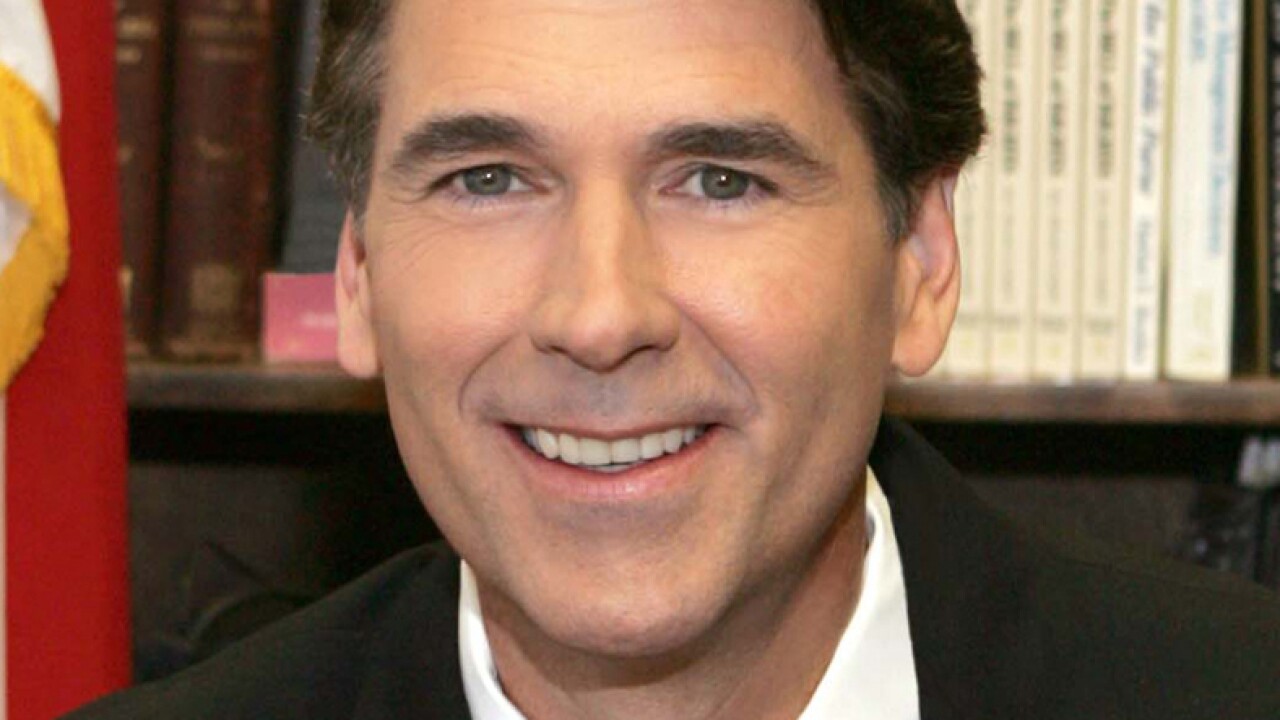

Richard Moore, CEO of First Bancorp in North Carolina, believes he can unlock more shareholder value through acquisitions and by taking advantage of disruption elsewhere.

May 3 -

The company, which delisted from the Nasdaq in 2005, is looking to raise up to $64 million through an initial public offering.

May 2 -

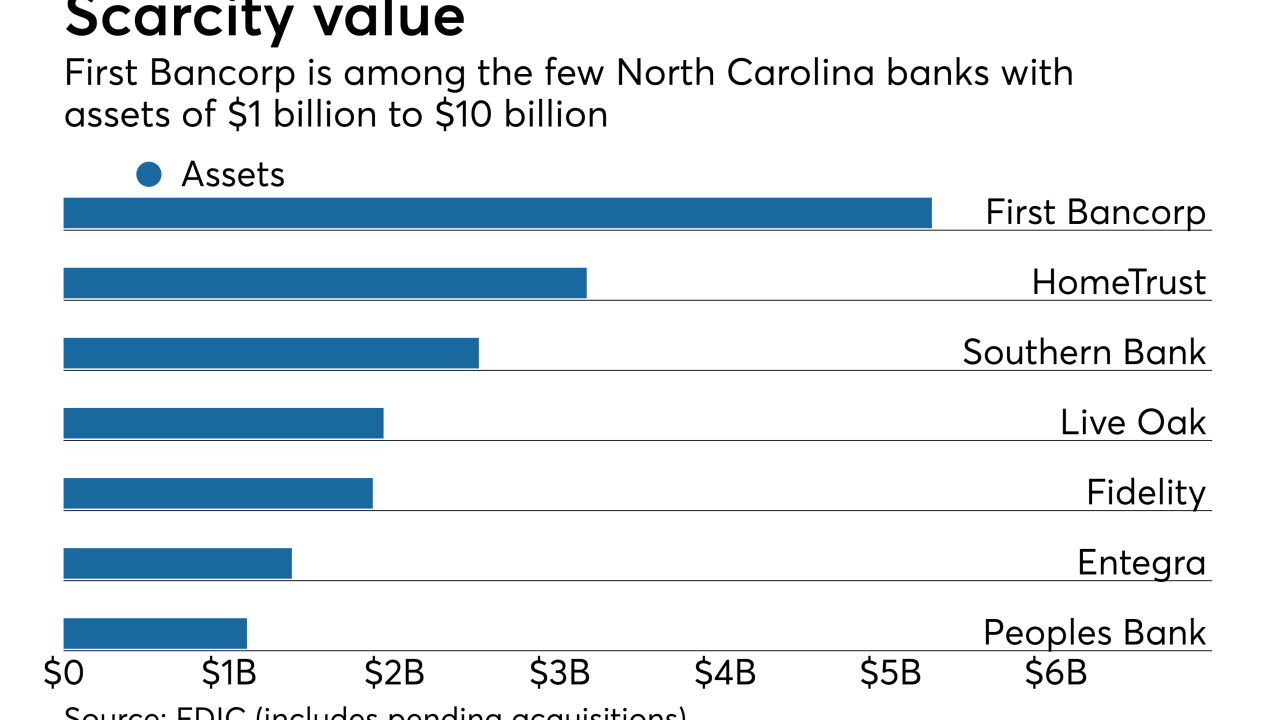

First Bancorp has emerged as one of the few consolidators in North Carolina at a time when many other banks in the state have opted to sell.

May 1 -

The $34 million acquisition is expected to strengthen Central Valley's banking operations in northern California.

May 1 -

The acquisition will provide South State with more than $3 billion in assets and a larger operation in North Carolina.

April 27 -

Sierra will pay $36 million for the parent of the $257 million-asset Ojai Community Bank in a deal that should close by the end of this year.

April 25 -

The deal is the latest coastal acquisition for United Community. For HCSB, the sale is the final chapter in a turnaround that began 13 months earlier.

April 20 -

Mariner Kemper, UMB's chief executive, said he struggled with the decision to sell Scout Investments to Raymond James. Selling made more sense than pumping more capital into the beleaguered business.

April 20 -

The Office of the Comptroller of the Currency has given preliminary conditional approval for Winter Park National Bank, allowing organizers to work on office space, hire staff and raise capital.

April 20 -

The company has hired an investment bank to help it consider strategic alternatives, which could also include recapitalizing.

April 20 -

Stakeholders have until May 9 to offer their thoughts on how to design an additional source of capital for credit unions.

April 12 CUNA Mutual Group

CUNA Mutual Group -

The deal, which is expected to close in the fourth quarter, values Cornerstone at $25.8 million.

April 12 -

Anchor's sale agreement comes less than a year after it put a representative of the activist investor Stilwell Group on its board.

April 12 -

Ashton Ryan, who had been removed as CEO in December, had been serving as its president. The New Orleans company also agreed to sell preferred stock to directors to help it make payments tied to its subordinated debt.

April 7 -

The deal, which is expected to close in the fourth quarter, should significantly increase PacWest's operations in Southern California.

April 6