Community banking

Community banking

-

Community banks are less likely to close branch locations than their larger counterparts. But those branches should mix technology with the homespun local flavor customers have come to expect.

July 7 -

Online and mobile banking are essential elements in 21st-century financial services, but there’s more to banking than digital transactions.

July 6 -

Green Bancorp has pivoted from the troubled energy-lending market to SBA loans, which are appealing to more small banks because they can be sold at a premium and are getting more support from Washington.

July 6 -

Scholarships, groundbreakings, donations to worthwhile causes and other ways credit unions are giving back to the communities they serve.

July 5 -

Sellers may shy away from partnering with banks that rely too heavily on one individual for their success, so buyers must show they are ready to handle unexpected departures or illnesses involving key personnel.

July 5 -

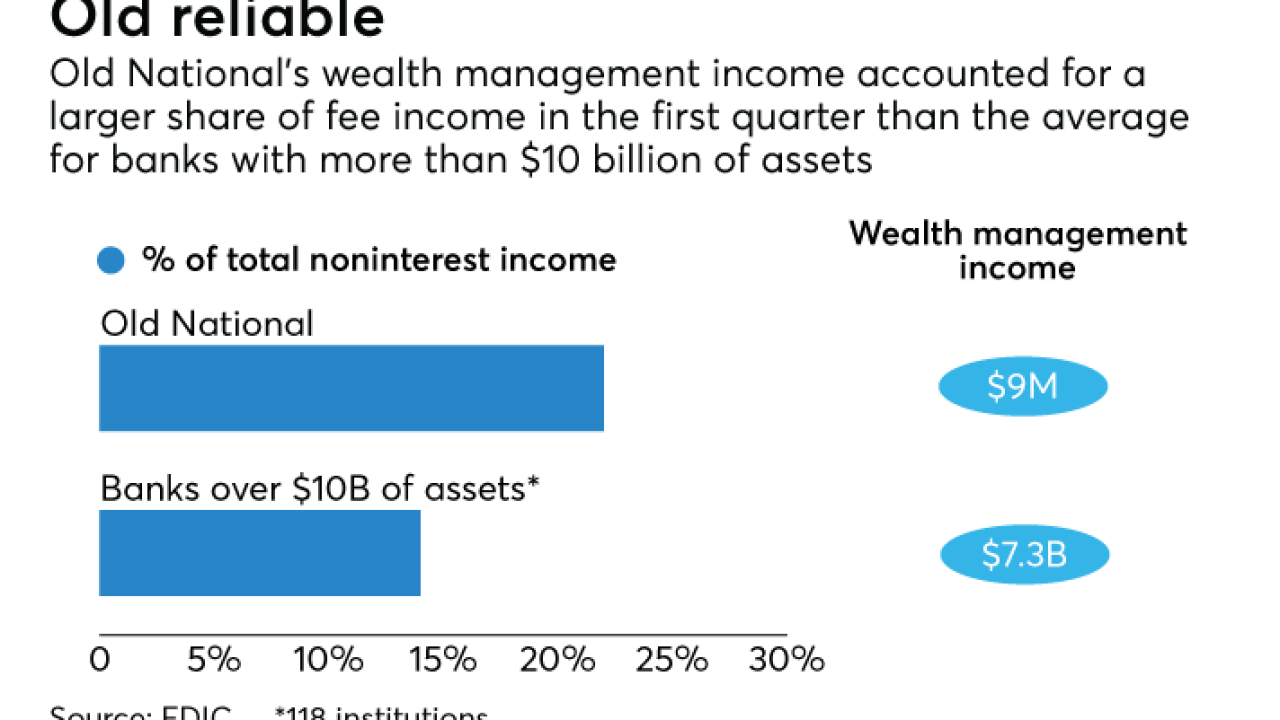

It might seem unusual for an Old National Bancorp to lure away a regional executive from the much larger Fifth Third, but not in wealth management, where competitiveness can be as much about emphasis as size.

July 3 -

Its agreement to sell two branches to another Louisiana bank is part of a broader plan by MidSouth's new CEO to eliminate seven branches.

July 3 -

Rob Kunisch will succeed Jack Steil as CEO of 1st Mariner Bank, which has been seeking to right itself after years of difficulties.

July 3 -

Raising funds for advocacy, life-saving research and other worthy causes.

July 3 -

From the largest banks to the smallest independents, policymakers want to hear the mortgage industry speak with one voice in the critical efforts to reform the government-sponsored enterprises.

July 3 -

Though they face an array of competitive threats — from digital currencies to peer-to-peer payment apps — the vast majority of community banks do not have a payments strategy, according to a recent survey.

June 30 -

With a new core system, Surety Bank plans to connect with customers outside of its geographic market.

June 30 -

Timothy Zimmerman, who once called CECL a dangerous proposal, now sees a justification for the FASB standard. And he is urging bankers to start working on plans to comply with the change.

June 30 -

Readers criticized a credit union securitization proposal, weighed in on scaling back the CFPB’s complaint database, debated the need for banks to examine gender-based salary comparisons, and more.

June 30 -

Lansing, Mich. is working with area financial institutions -- including a local credit union -- to open accounts for people coming out of prison.

June 30 -

Whether in Washington, California, Nevada or elsewhere across the globe, credit union supporters took part in two of the movement's biggest annual events, raising money for Children's Miracle Network Hospitals

June 30 -

Steven Klein, the company's president, will become its CEO in early November.

June 29 -

While overall activity remains slow, sellers — particularly those flush with core deposits — are fetching premiums not seen in years.

June 29 -

Lansing, Mich., is working with area banks to open accounts for people coming out of prison.

June 28 -

Honoring student achievement, celebrating institutional success, and a friendly face-off between credit unions and banks are all part of the latest round-up of credit union community news.

June 28