-

With the ink barely dry on the Consumer Financial Protection Bureau's final arbitration rule, defenders and critics of the rule were already girding for a congressional fight over its ultimate fate.

July 10 -

With the ink barely dry on the Consumer Financial Protection Bureau's final arbitration rule, defenders and critics of the rule were already girding for a congressional fight over its ultimate fate.

July 10 -

Jerome Powell says it's “now or never” to cut the government’s role in mortgage finance; Justice Department is monitoring eight banks for suspected money laundering.

July 7 -

A judge has approved the inclusion of new payday lenders in a case seeking relief from the effects of Operation Choke Point, and denied defendants' motion for summary judgment against Advance America.

July 6 -

The renewed debate on reforming Fannie Mae and Freddie Mac is focused on how small and midsize banks would be affected.

July 5 -

If HSBC reaches an agreement with the government, it could give an early indication of how the Trump administration will levy financial penalties.

July 5 -

Transaction laundering is gaining steam, and since it uses familiar payment technology, it can be easier to use than virtual currency, writes Ron Teicher of EverCompliant.

July 5 EverCompliant

EverCompliant -

The half-dozen former credit union employees are barred form partcipating in the affairs of any federally insured financial institution.

June 30 -

More e-commerce and multi-channel merchants are accepting payments from mobile devices, even though they haven't addressed all of the security gaps inherent to the technology.

June 29 -

The bill would help financial institutions with customer due diligence and identifying corporate beneficial ownership of business customers.

June 28 -

Executives at four former credit repair companies agree to pay $2 million for charging consumers millions in illegal advance fees.

June 27 -

Payment companies have lots of emerging regulations. Regtech can bring together different stakeholders to ease compliance.

June 27 Waymark Tech

Waymark Tech -

A federal appeals court is scheduled to hear oral arguments in August in a decade-old case against the San Francisco bank that could cost it hundreds of millions in penalties and restitution.

June 26 -

As the U.S. chip card migration crawls ahead, companies that have not made the switch are at a particularly high risk for fraud.

June 23 -

As self-checkout gains steam, so does the risk for shrink, or intentional underscanning. There are some things retailers can do to mitigate the problem, including appealing to consumers' own morality.

June 22 -

U.S. banks and credit unions face a tricky calculus in deciding whether to adopt expensive technology aimed at reducing online fraud.

June 22 -

House Democrats are ultimately hoping that the Deutsche investigation will provide more information about President Trump’s business dealings with Russia.

June 22 -

U.S. banks face a tricky calculus in deciding whether to adopt expensive technology aimed at reducing online fraud.

June 21 -

For Democrats, the scandal is a prominent symbol of big-bank misbehavior, while Republicans want to use it to show the shortcomings of the CFPB.

June 21 -

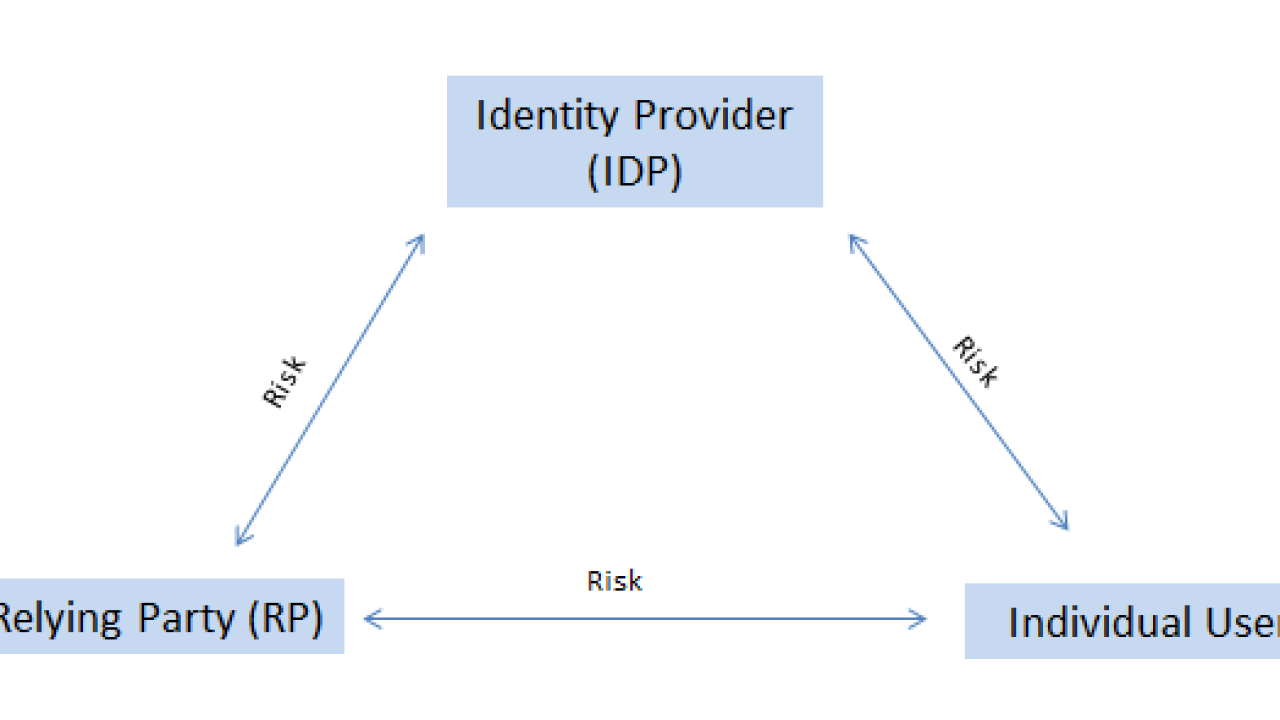

Portable digital identities could improve customer experience, cut costs and generate revenue for banks. But who’s on the hook when something goes wrong?

June 21