-

The credit union’s new name and imagery are intended to represent financial empowerment for consumers.

June 27 -

Financial firms say the database is unreliable and would like to see it removed from public view. But the industry would also lose access to competitive insights that can be gleaned from the massive trove of consumer complaints.

June 26 -

Alice Frazier had been chief operating officer at Cardinal Financial, which was bought earlier this year by United Bankshares.

June 26 -

Banks are making it easier to log in, adding expense trackers and simplifying payments as they try to get corporate clients to use mobile more.

June 26 -

Bernstein will retire from the Colorado Springs-based credit union in October, at which time current EVP Chad Graves will take the helm.

June 26 -

ES Bancshares, which recently sold a branch near Poughkeepsie, plans to open second branches in the two boroughs.

June 23 -

As young people mature, their financial and payment needs mature, as does their use of technology and other emerging innovation.

June 23 -

IdentityMind Global will offer Confirm.io’s remote document verification technology to its clients.

June 22 -

Recruiting a strong lending team, board elections, special awards and more credit union professionals in the news.

June 22 -

The Virginia company told investors that Morgan Davis, its president, will soon succeed founding CEO Robert Aston, who is retiring.

June 22 -

One of the biggest challenges after a merger is deciding which people to keep and which to let go. Learning to identify certain habits and skills could simplify those decisions.

June 22 -

Banks continue to struggle in wooing millennials, but their customer acquisition challenge is about to get even more complicated as Generation Z comes of age.

June 22 Firstborn

Firstborn -

Moves like Amazon Go and the e-commerce giant's acquisition of Whole Foods require banks to abandon their "defensive" innovation posture, write Richard Oglesby and Brad Margol from AZ Payments Group.

June 22 AZ Payments Group

AZ Payments Group -

Royal Bank of Canada, the country’s second-largest lender by assets, is cutting about 450 positions, mostly at its headquarters.

June 21 -

Chemical Financial was caught off guard by CEO David Ramaker's decision to retire. Fortunately, Chemical had retained Talmer Bancorp CEO David Provost after buying his bank a year earlier.

June 21 -

Vinny Lingham, founder and CEO of Civic, discusses the froth in cryptocurrency markets, the mania for "initial coin offerings," the right way to do token sales, the future of digital identity and the banking system's security failings.

June 21 -

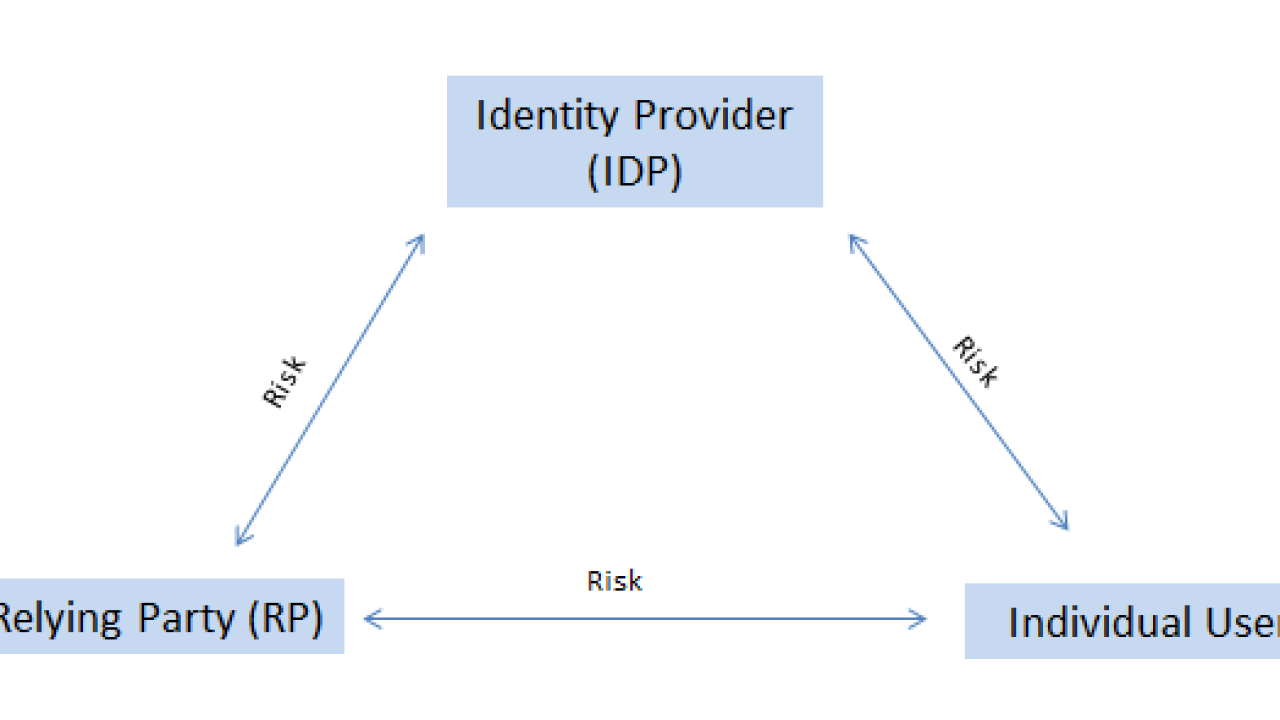

Portable digital identities could improve customer experience, cut costs and generate revenue for banks. But who’s on the hook when something goes wrong?

June 21 -

SkyOne shuffles up its senior management team and more credit union executives in the news.

June 21 -

When brewery software provider OpHouse strated to grow, it turned to its CEO's connections in the tech incubator community to find a new payments gateway

June 21 -

David Provost will succeed David Ramaker as the Michigan company's CEO. Provost ran Talmer Bancorp, which Chemical bought last year.

June 21