Markets were bracing for the chaos of a regional war; banks may be the target of sophisticated cyberattacks, experts warn.

Bank employees are likely adopting the OpenClaw AI assistant on the sly to boost productivity, but the tool's deep integration exposes networks to cyber threats.

-

Recent reports from JD Power suggest that more customers choose payment alternatives to avoid surcharge fees.

-

Noelle Acheson argues that stablecoins can help community banks deepen relationships with their customers, help them explore new forms of capital formation and strengthen their own exposure to risk.

-

In this week's American Banker global payments and fintech roundup, Revolut, Tether and Circle made announcements designed to improve their standing in the stablecoin market. That comes amid new research from McKinsey that says the digital asset is growing quickly, but has not made even a small dent in payments.

Cybersecurity stocks tumbled after Anthropic unveiled a new vulnerability scanner, prompting vendors to defend their runtime protection platforms.

Fulton Financial received the necessary approvals to acquire Blue Foundry Bancorp; JPMorgan hired two Bank of America health care veterans while shuffling leadership; Mizuho Financial Group has plans to replace about 5,000 administrative jobs with artificial intelligence over the next 10 years; and more in this week's banking news roundup.

A final rule published by the Office of the Comptroller of the Currency Friday will formalize a 2021 interpretive guidance allowing national trust banks to perform non-fiduciary custody. The banking industry complained that the rule runs counter to the traditional scope of the charter.

-

The responsible gathering of data on consumers is intrinsic to the verification tools that keep everyone safe from identity theft and other forms of fraud. Blanket attacks on "data brokers" will harm consumers, not help them.

-

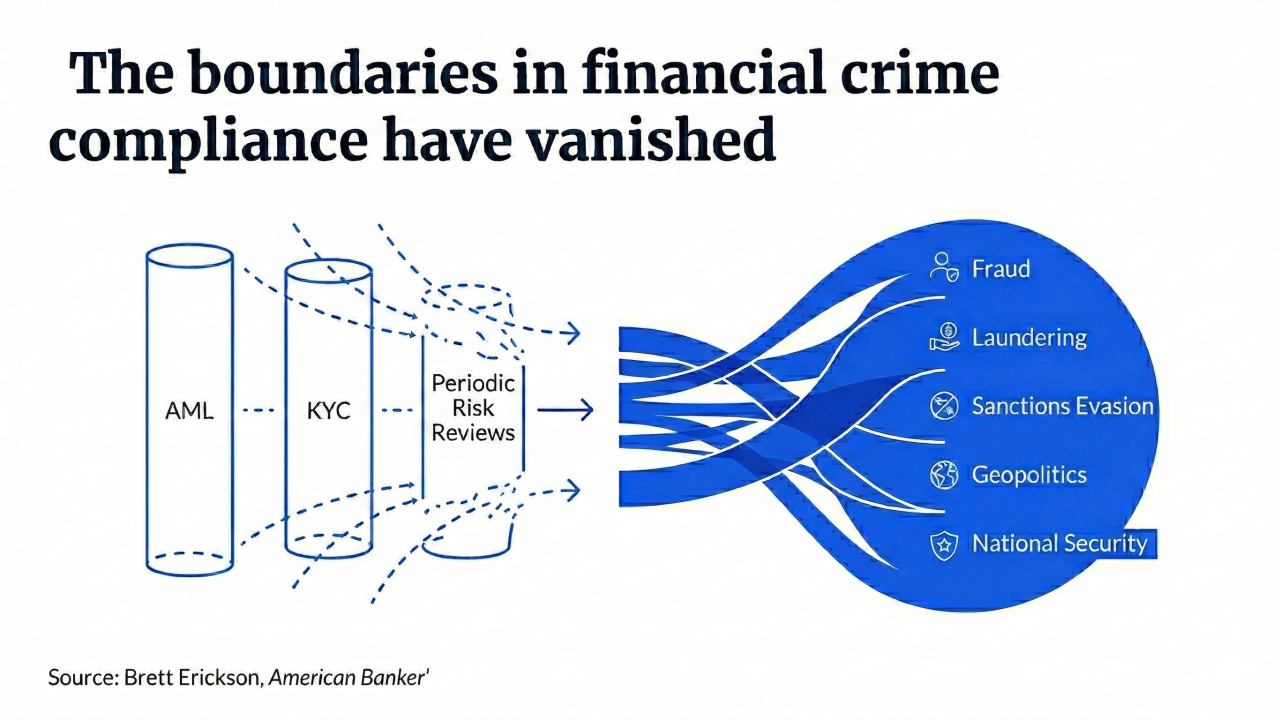

The threats posed by financial criminals, from fraudsters to money launderers, are evolving at a pace that far outstrips the education of bankers charged with combating them. That needs to change.

-

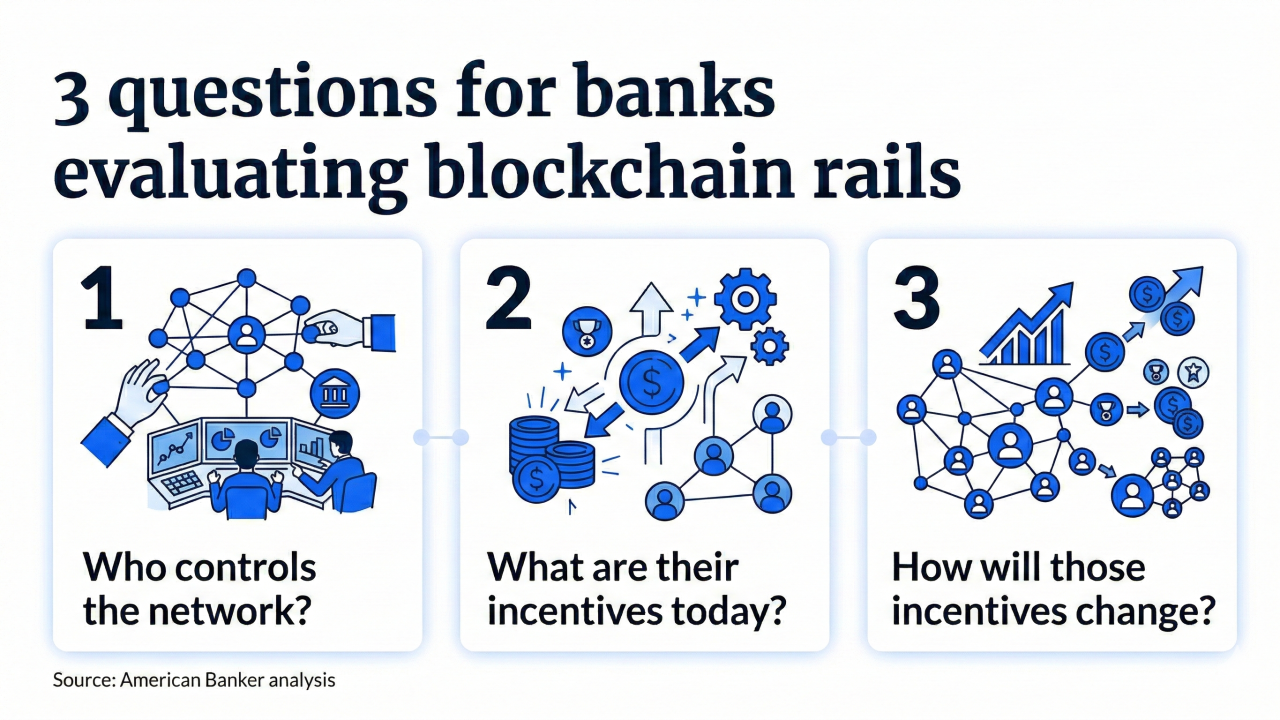

Decisions about the kind of blockchains to use in rolling out banking products creates future path dependencies. It's important that banks get this decision right.

-

Fintech lenders are positioned to help businesses navigate the latest round of global tariffs announced by President Trump, even as the volatility causes overall decreases in loans.

-

The Royal Bank of Canada's base outlook is that tariffs will remain at their current levels. But it also sees a possibility that U.S. trade policy will bring on a severe North American recession.

-

The bill, offered by Sens. Catherine Cortez Masto, D-Nev., and Todd Young, R-Ind., would allow Federal Home Loan bank members to establish tax-exempt community infrastructure development bonds.

-

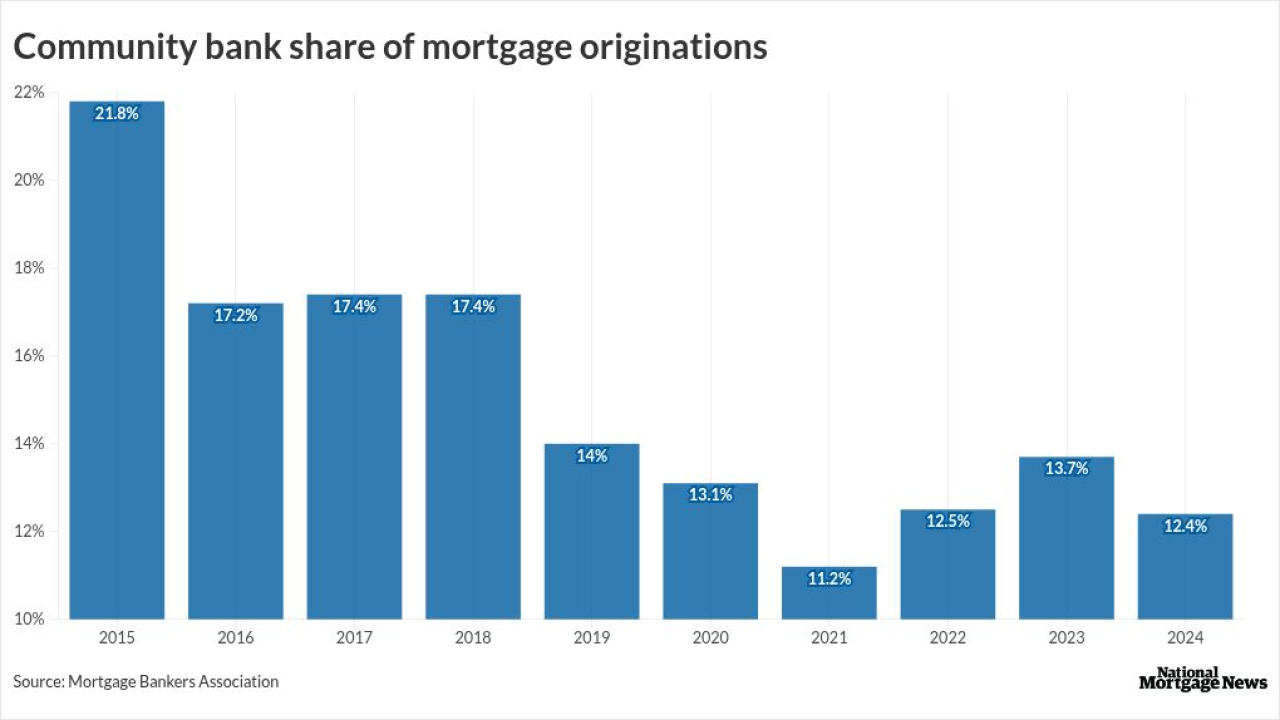

Willamette Valley Bank cited consumer shifts to nonbanks and stubborn interest rates behind the decision, joining a line of institutions to exit since 2025.

-

Comptroller of the Currency Jonathan Gould took several assertive stances at a Senate Banking Committee hearing Thursday, minimizing concerns about banks' potential compliance costs to collect citizenship data and sidestepping questions about World Liberty Financial's trust charter application.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The annual rankings honor the notable performances of individuals in banking and finance and as teams.

Call for submissions for women 40 years and younger who are rising leaders at their bank or financial institution.

The 23rd annual ranking of women leaders in the banking industry.

-

-

- Sponsored by S&P Global

- Sponsored by S&P Global