The retail giant is betting on the mainstream appeal of digital assets, while Lloyds' cash-preservation strategy gains steam. That and more in American Banker's global payments and fintech roundup.

Under pressure from regulators to beef up risk management in commercial real estate lending, banks are using new software tools to improve analysis.

-

The public will now have an additional two months to weigh in on expanded operating hours for its Fedwire Funds and the National Settlement services.

-

U.K. banks are testing machines that can accept deposits from multiple machines.

-

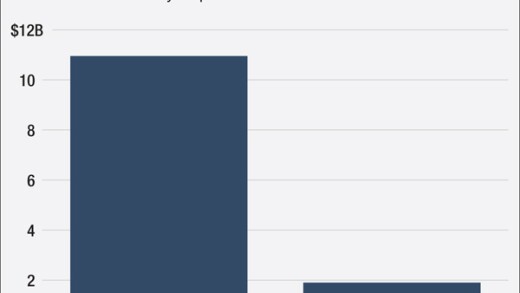

Publicly traded companies are showing signs of improvement, but it may take some time until venture capital funding for fintechs recovers.

E-commerce merchants battling fraud that comes from multiple directions often need to use several different solutions that don’t always mesh well, bogging down the checkout process and inadvertently blocking good transactions.

The National Community Reinvestment Coalition and four fintechs want the agencies to act on the White House's executive order on artificial intelligence.

A federal judge granted a preliminary injunction that preserves the Consumer Financial Protection Bureau's existence, reinstates fired employees and contracts, requires data be preserved and mandates that employees go back to work.

-

Synthetic fraud — which combines real and false identifying information — has been a niche variety of identity theft for some time. But recent advancements in artificial intelligence and people's access to it might bring it into the mainstream in a big way.

-

Banks know what they're looking for. Here are key ways to show them that you can bring it to the table.

-

California's bid to regulate EWA programs as though they are loans would harm workers, companies and the state's economy.

-

As consumers use digital subscriptions for everything from streaming movies to cooking meals, financial apps are taking different approaches to helping their customers navigate recurring payments. Should banks get in on the action?

-

While new jobs data contributed to falling Treasury yields, mortgage rates showed a mixed picture with some trackers moving in opposite directions.

-

The payments company is opening its real-time payments network, Visa Direct, to stablecoins through a prefunding pilot that will allow businesses to move money across borders when banks are closed.

-

Two large companies' announcements that they're laying off thousands of people they've deemed not AI-savvy have drawn mostly negative reactions.

-

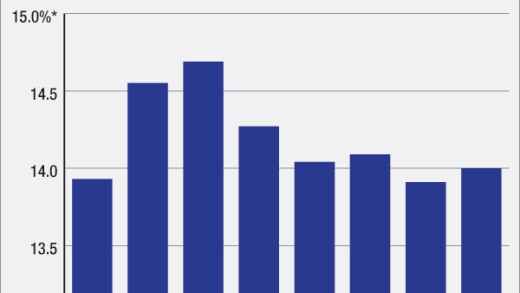

The credit scoring agency's rollout comes after years of criticism from home lenders over its prices, with delivery costs rising over 40% in the past year.

-

The Consumer Financial Protection Bureau will delay its small-business lending data rule by a year, citing litigation and plans to rewrite the regulation in the interim as reasons for the delay.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

JPMorganChase, BNY, Citi and others are getting ready to launch autonomous digital workers, but for most, several pieces need to be in place before they can go live.

An appeals court's decision will make it harder for consumer-lending-focused fintechs to operate in Colorado. But the impact could eventually be felt more widely, according to both industry groups and consumer advocates.

The 23rd annual ranking of women leaders in the banking industry.

- Partner Insights from Cash Connect

- Partner Insights from Cash Connect

-

- Sponsor content from Podium