Senate Banking Committee ranking member Elizabeth Warren, D-Mass., led a group of congressional Democrats in a letter to bank regulators telling them that loosening capital rules wouldn't improve the Treasury market's functioning.

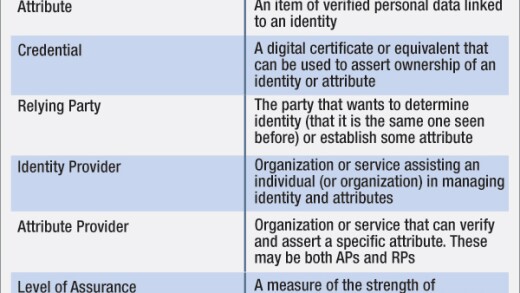

Banks have to know a lot about their customers, who generally trust them to keep personal information secure. Who better to serve as digital identity providers in a post-password world?

-

Thomas Halpin, who heads global cash management for North America, talks about real-time processing, generative AI, central bank digital currencies and why the ISO 20022 messaging standard is cool.

-

Credit card late fees are annoying, but that's why they work as a disincentive to prevent late payments. By making them much smaller, the CFPB will actually be working against the interests of low-income consumers.

-

Ant Group, the company behind Alipay, plans to set up independent boards for its international, database and digital technologies operations as it pushes forward the overhaul of its fintech business, according to a memo seen by Bloomberg.

Federal Reserve Vice Chair Philip Jefferson said in a speech Friday that long-term productivity gains brought on by artificial intelligence could compel the central bank to maintain higher rates to keep prices stable.

The Northeast regional bank missed expectations on net interest income and negatively revised much of its 2024 guidance.

Banks' latest annual reports, filed in the early weeks of the second Trump administration, provide a window into how the industry is adjusting to a new political climate.

-

The Federal Housing Finance Agency may have gotten more than it bargained for in its review of the Home Loan banks, but there is little doubt that the effort will result in significant structural change.

-

The agency should be asking why, in today's America, there is anyone who wants a full-service checking account but can't get one.

-

The agency needs to demonstrate the moral courage necessary to break up unmanageably large banks.

-

The operation washed checks stolen from USPS boxes and used "money mules" recruited on Instagram, causing financial and personal distress for victims.

-

The money transfer fintech expanded its Austin office 200% to 90,000 square feet as it looks toward accelerating growth in North America. The company also separately inked a new partnership with Upwork to add Wise Platform as an infrastructure provider for freelancer payouts.

-

Federal Reserve Chair Jerome Powell said in a speech Tuesday that the central bank's policy stance is "modestly restrictive," a stance that will give the central bank flexibility to react to an uncertain economic future.

-

The credit score provider has developed "focused" language artificial intelligence models purpose-built for tasks like detecting payment fraud, assessing risk and recommending next best actions.

-

Students are collaborating with credit specialists at the lending platform to build agentic AI models for small business lending and for helping small business owners manage their finances.

-

Six class action lawsuits seek over $5 million after an insider accessed sensitive records.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Comptroller of the Currency Jonathan Gould said Tuesday that chartering compliant fintechs is "the only way" to level the playing field between banks and nonbanks. His comments come as the Office of the Comptroller of the Currency weighs new trust charters and stablecoin rules.

In her first public appearance since President Trump moved to fire her from the Federal Reserve Board of Governors, Fed Gov. Lisa Cook reiterated her commitment to bringing inflation under 2% and said that the labor market remains "solid."

The 23rd annual ranking of women leaders in the banking industry.

-

- Sponsor Content from IBM Cloud

-

- Sponsor Content from Total Expert