-

In a blog post published Thursday, Neel Kashkari criticized key parts of Jamie Dimon’s annual letter to JPMorgan Chase shareholders.

April 6 -

Richmond Federal Reserve Bank President Jeffrey Lacker’s revelation that he was behind a 2012 leak may embolden the central bank’s critics in Congress.

April 6 -

Access to banking information ensures advisors can perform holistic planning, fintech firms say.

April 5 -

Speaking at a town hall event in Washington, JPMorgan Chase CEO Jamie Dimon said that post-crisis regulations have made mortgages too costly for consumers — and made homeownership unattainable for borrowers with low incomes or blemished credit histories.

April 4 -

Sen. Pat Toomey, R-Pa., asked the Government Accountability Office to weigh in on whether two pieces of bank regulatory guidance are in fact rules for the purposes of the Congressional Review Act.

March 31 -

With slim odds of getting eight Democrats to support major Dodd-Frank Act reforms, Republicans are turning to other measures to make changes to the 2010 reform law.

March 30 -

During a panel discussion Tuesday, regulators said they are trying not to crack down too hard on sales incentive programs and fix problems that bankers have identified with the exam system.

March 21 -

Community bankers want a two-year span between exams for small banks in good standing. Regulators, however, are reluctant to revert to pre-crisis policies.

March 20 -

Attendees at this year's Independent Community Bankers of America convention are being urged to lobby hard to get regulatory relief moved closer to the top of Washington's to-do list.

March 17 -

Fed Chair Janet Yellen cast doubt on the administration’s call for a reinstatement of a Depression-era barrier between commercial and investment banking activities.

March 15 -

Scott Heitkamp is encouraged by a more positive tone coming from President Trump. His goal in the next year is to make regulation easier for his fellow bankers.

March 15 -

HCSB Financial received a second subpoena from the Troubled Asset Relief Program's special inspector general.

March 8 -

The recent decision by the Federal Reserve Board to exempt banks with less than $250 billion in assets from the qualitative aspects of the CCAR stress tests may be a sign of things to come, says Joo-Yung Lee, head of North American financial institutions at Fitch Ratings.

March 3 -

Under the Trump administration, the challenge for the industry is to find the proper balance between supporting post-financial crisis regulations that have worked well and campaigning for reform efforts that have been ineffective.

March 2

-

Regulators ought to make it easier for smaller institutions to merge, the CEO of the country's largest said Tuesday.

February 28 -

The SEC is investigating the bank for selling clients mutual funds that charge marketing fees when other, cheaper funds were available. SunTrust expects an enforcement action.

February 27 -

Attendees at an American Bankers Association conference believe a massive overhaul of banking regulations is unlikely.

February 21 -

Instead of focusing on wanting deregulation, the industry should be driving home the credit union difference as the reason why CUs are worthy of special treatment.

February 10Greylock Federal Credit Union -

China's role in the in bitcoin market has increased in recent years as its citizens are among the virtual currency's leading traders and miners.

February 10 -

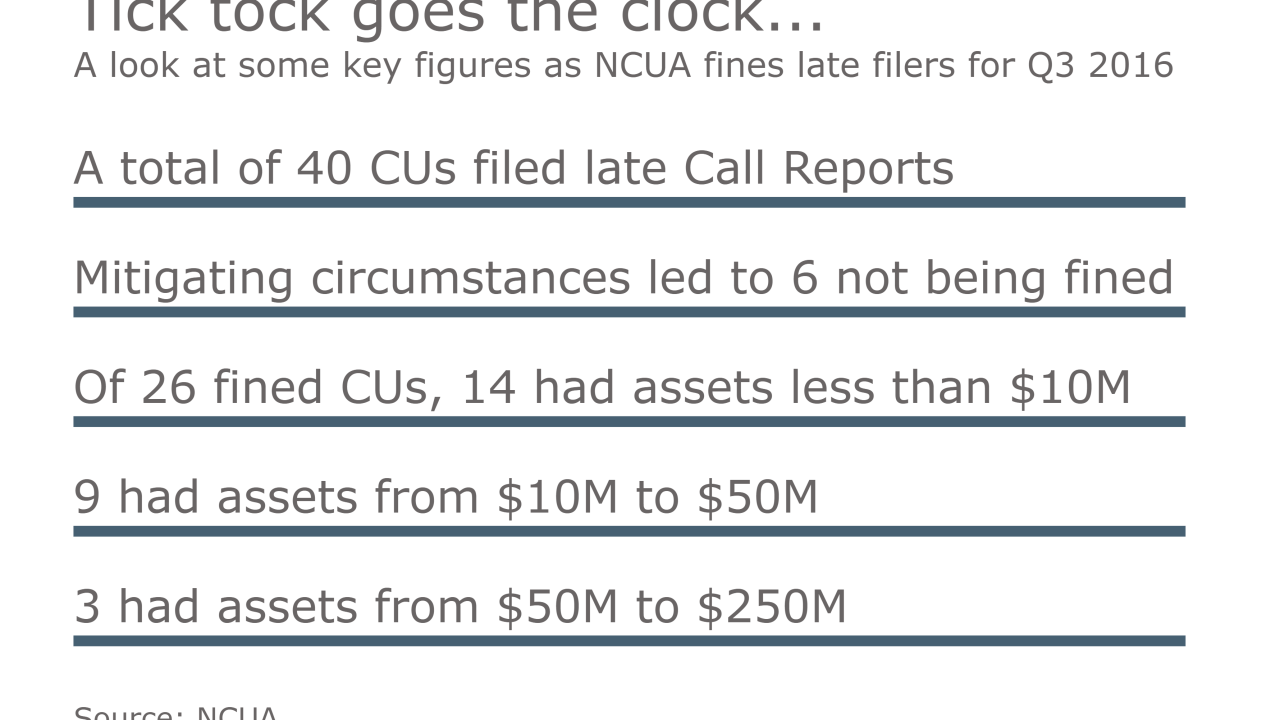

No CUs with assets of more than $250 million were subject to civil monetary penalties for filing late Call Reports.

February 8