-

Changing political and economic forces are raising new questions about deployment of tax savings and the cost of deposits, while old concerns about cost-cutting, credit quality and risk-taking persist or return.

January 3 -

The Fed’s rate hike on Tuesday will raise bank's funding costs, serving as a stark reminder that a return to strong, broad-based business loan demand can’t come soon enough.

December 13 -

It’s only early December, but bank CEOs’ comments this week about tax reform, their thirst for deposits, consumer lending initiatives, and challenges in commercial lending offer a sneak peek at what’s coming when earnings season begins next month.

December 7 -

It was mostly good news for banks in the Federal Deposit Insurance Corp.'s Quarterly Banking Profile, with higher earnings and net interest margins. But there were concerns as well, including slower loan and deposit growth.

November 21 -

The Providence, R.I., company surpassed its goal for return on tangible common equity that it had set for itself after its initial public offering.

October 20 -

The Green Bay, Wis., company's CEO predicted “mid-single-digit” annual loan growth after a third quarter that included a 10% increase in deposits and 4% rise in average loans.

October 20 -

Total loans fell 1.6% at the North Carolina-based regional bank, which has been scaling back in key segments such as residential mortgages and auto. Wider margins offset that reduction, but earnings were flat and revenue growth small.

October 19 -

Strong gains in net interest income offset a decline in fee income, but a recent settlement with the federal government over alleged misconduct at its Wilmington Trust unit weighed on the Buffalo company's overall results.

October 18 -

Net interest margin widened 12 basis points, too. Those lending results offset a decline in fee income at the Minneapolis company, which saw earnings rise 4%.

October 18 -

The Tennessee company reported 6% growth in loans, which included strong C&I and CRE grains. However, revenue shrank thanks partly to a steep falloff in fixed-income fees.

October 14 -

The Pittsburgh company benefited from loan growth and higher interest rates, though fee income fell and expense rose in the third quarter.

October 13 -

Total revenue rose less than 1% to $21.8 billion, but expenses declined 2.5% to $13.1 billion. That computed to the highest profit at Bank of America in six years.

October 13 -

An increase in corporate loans, the highest lending margin in four and a half years and record profit in asset management helped the lender top analysts’ estimates and offset trading and other challenges.

October 12 -

Profits rose 20% at the Texas bank, but net interest margin growth last quarter, and the bank’s margin outlook for the rest of this year, disappointed analysts and investors.

July 27 -

Just as pre-crisis success was illusory, so too might be expectations that banks could ever regain that type of profit growth again.

July 25

-

Net interest income rose 7% and margins widened 17 basis points at the Wayzata, Minn., company.

July 24 -

The Rhode Island bank plans to build out its fee income capabilities, expand C&I lending in the Southeast, renegotiate vendor contracts and take other steps to produce expense cuts and revenue enhancements of at least $90 million.

July 21 -

The Cincinnati company reaped the benefit of the latest round of interest rate hikes, as a higher net interest margin and lower costs helped overcome the drop in lending.

July 21 -

The regional bank reported an 8% gain in fee income and trimmed costs amid 1% loan growth.

July 20 -

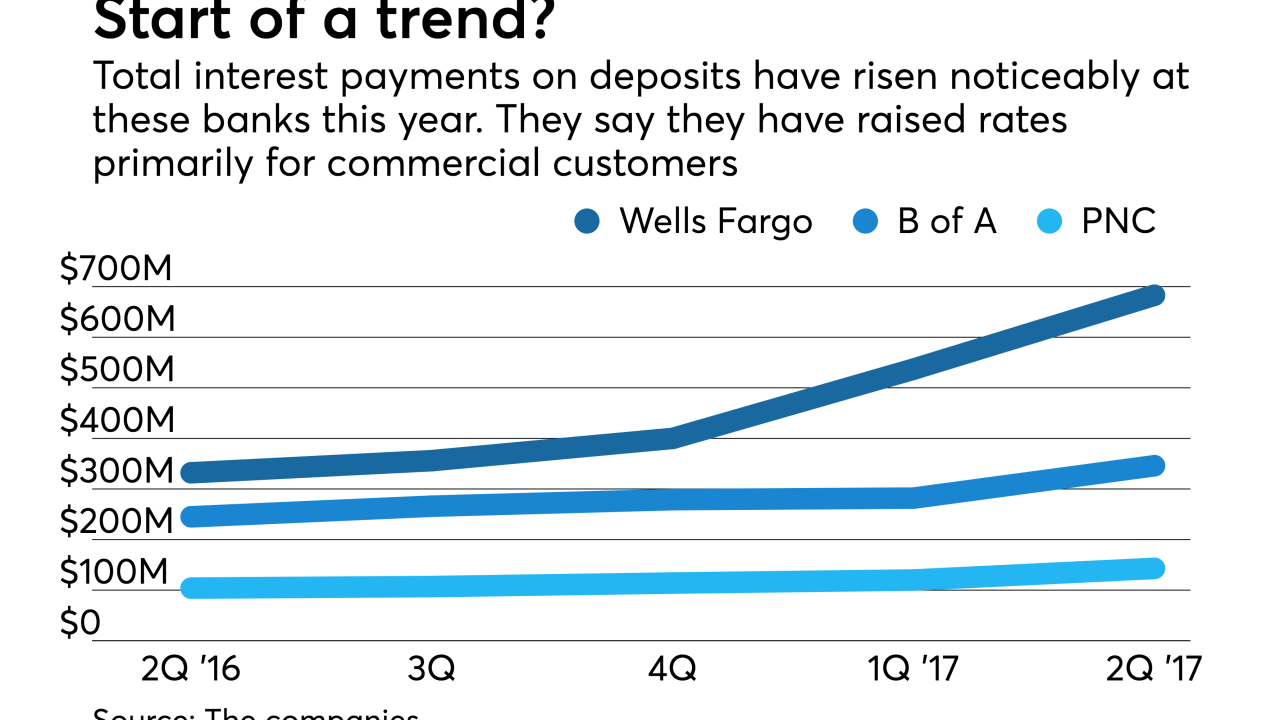

In a sign of broader competition ahead, bigger banks are raising the interest they pay on deposits held by business customers. The big question is how hard will it be for banks to maintain margins and to stave off consumer demands for better rates.

July 18