KeyCorp

KeyCorp

With assets of over $170 billion, Ohio-based KeyCorp's bank footprint spans 16 states, but it is predominantly concentrated in its two largest markets: Ohio and New York. KeyCorp is primarily focused on serving middle-market commercial clients through a hybrid community/corporate bank model.

-

It’s only early December, but bank CEOs’ comments this week about tax reform, their thirst for deposits, consumer lending initiatives, and challenges in commercial lending offer a sneak peek at what’s coming when earnings season begins next month.

December 7 -

Beth Mooney is taking KeyCorp to new heights through bold dealmaking and with a relentless commitment to doing what's right for customers, employees and communities.

November 26 -

Fintechs should learn to value risk management — and the necessary bureaucracy that comes with it, bankers said this week in defending themselves again criticism that they are a pain in the neck to work with.

November 8 -

Chenault to leave credit card giant helm after 16 years, vice chairman will take his place; Brett Redfearn named the agency’s director of trading and markets.

October 19 -

The Cleveland company's third-quarter profit more than doubled from the same period last year, thanks largely to its 2016 acquisition of Buffalo-based First Niagara Financial Group.

October 19 -

KeyCorp's $4.1 billion purchase of First Niagara is being hailed as a success, and Amy Brady deserves substantial credit.

September 25 -

Flush with cash, many commercial firms are also opting to pay down debt rather than take on new loans, and those seeking financing aren’t always turning to banks to meet their needs.

September 15 -

Revenue from overdrafts keeps rising, according to new FDIC data, even though the controversial product still has a bull’s-eye on its back. Clearer disclosures and higher consumer confidence are the big reasons.

September 8 -

New European standards require greater data sharing to accommodate faster transaction processing, mobile payments and other digital efforts — a trend that is also inspiring new collaborations across the pond.

August 30 -

New York-based Cain Brothers advises both for-profit and not-for-profit health care organizations on mergers and acquisitions and financing strategies.

August 15 -

Six states and D.C. still charge in-network fees when unemployed workers cash in assistance delivered through prepaid cards.

August 2 -

Revenue growth in its merchant payments business is expected to be tepid in the foreseeable future. The Minneapolis company says it is looking to ramp up innovation to stay competitive in a business that has been upended by fintech firms and online shopping.

July 19 -

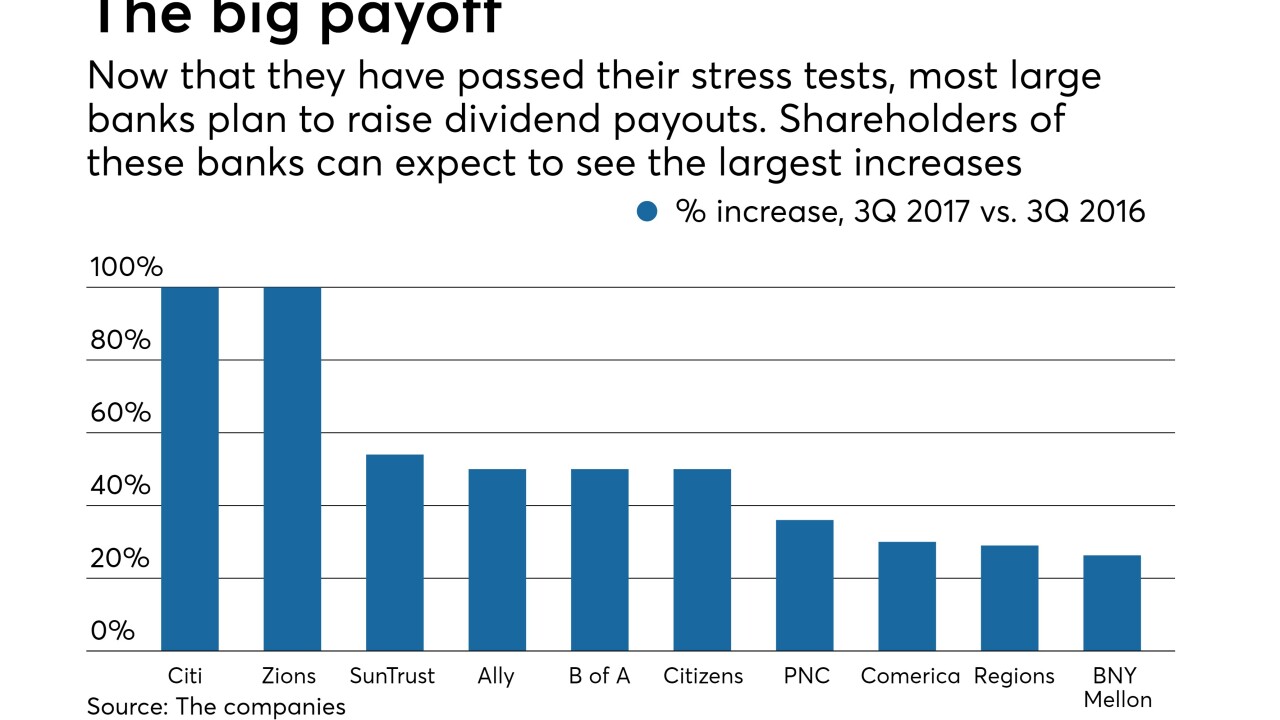

Higher dividends and more aggressive repurchase programs are bound to attract more investors, which could boost stock prices and prompt more dealmaking, analysts said.

June 29 -

Even with card defaults ticking up slightly, regional banks remain committed to pursuing more credit card business as they look to both diversify their balance sheets and deepen relationships with customers.

June 27 -

KeyCorp is acquiring HelloWallet, a personal financial management product it has offered its bank customers since 2015, from the investment research firm Morningstar.

May 31 -

Banks have warmed up to digital wealth management tools but will need to use their human advisers, too, to beat fintechs.

May 10 -

Fifth Third, Huntington Bancshares and KeyCorp are among the companies backing an effort to bring startups to the Buckeye State.

May 9 -

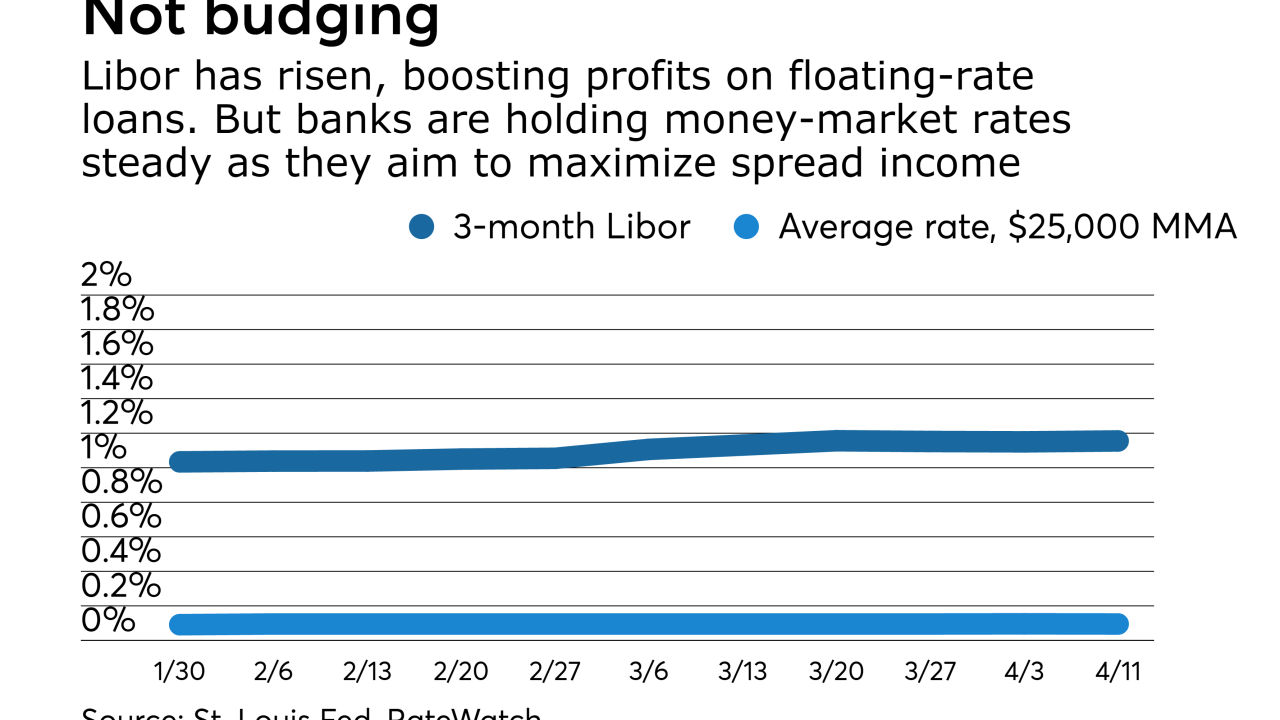

Even with net interest margins improving, banks are reluctant to raise rates on deposits until more floating-rate loans reprice. But how long can they wait before depositors start demanding higher yields?

April 24 -

Fees from capital markets activities have propelled profits at several regional banks when they needed it —and just as the Glass-Steagall redux crowd wants to kill that business.

April 21 -

Executives at BB&T, KeyCorp and Citizens are milking commercial lending niches and balancing cost control with new investments while waiting for more rate hikes to fatten margins.

April 20