Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

The insurance company, facing regulatory scrutiny and lawsuits over a former sales relationship with Wells Fargo, said it may press its partner to cover costs after halting the sales.

February 22 -

When Zelle launches, it will not allow users to share information about their payments with other folks in their network. That decision puts the P-to-P service on a different course than Venmo, its fast-growing rival.

February 22 -

Four retail managers are the first senior employees let go by the bank for their roles in the phony accounts scandal; federal court rules against investors in GSE suit.

February 22 -

When Zelle launches, it will not allow users to share information about their payments with other folks in their network. That decision puts the P-to-P service on a different course than Venmo, its fast-growing rival.

February 21 -

Wells Fargo has fired its consumer credit solutions head and three other senior managers for actions related to a scandal involving employees creating fraudulent customer accounts.

February 21 -

She will be joined on the board by Ronald Sargent, a retired chairman and CEO of the office-supply company Staples.

February 21 -

The number of new checking accounts at the embattled Wells Fargo fell by double digits year over year, and account closures remained brisk. Yet the figures on credit card applications were worse.

February 17 -

JPMorgan Chase and Wells Fargo are among the large institutions that are making fewer car loans amid intense price competition and concerns that lenders are at risk of bigger losses.

February 13 -

Some execs have plenty to be sour about, but others are emphasizing the possibilities amid today's economic and political realities. Their contrasting mindsets were on full display at a Credit Suisse conference this week.

February 10 -

The FDIC received eight new bank applications last year, not a lot but the most since the financial crisis; Wells' board is considering dropping bonuses for its top brass.

February 9 -

The bank's board is considering whether to withhold bonuses for CEO Tim Sloan and Chief Financial Officer John Shrewsberry.

February 8 -

CFO John Shrewsberry projects that legal costs and other expenses related to the scandal will swell to between $50 million and $60 million and remain at that level for the next several quarters.

February 8 -

Hong Kong and Singapore have long been economic crossroads. China and India are economies with vast populations. And Shenzhen is bursting with innovative creativity. All of these contribute to the Asian fintech market being far ahead in adoption and ecosystem creation.

February 3 -

By partnering with Intuit, Wells Fargo is continuing its journey toward API-based data sharing, and away from screen scraping.

February 3 -

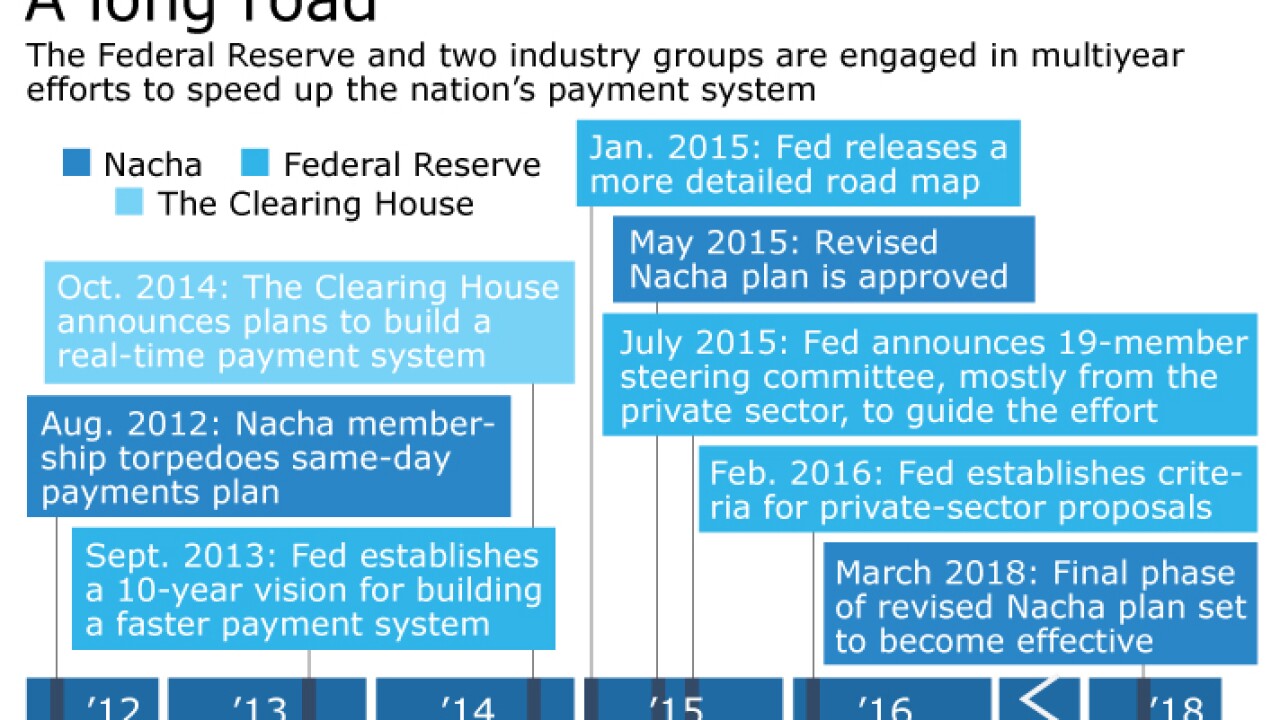

Several groups are developing real-time payments systems for the U.S., and most everyone agrees success is inevitable, but how quickly they can make enough progress to satisfy consumers is a point of contention.

February 1 -

The largest U.S. banks are treading lightly in response to President Trump's executive order banning travel to the U.S. by refugees and others from certain Muslim nations. Corporate statements emphasize the need for diversity while stopping short of outright opposition.

January 30 -

Despite their global reach, the largest U.S. banks mostly stayed quiet in response to President Trump’s ban stopping nationals from certain Muslim countries from entering the United States.

January 29 -

The upcoming launch of Zelle gives Chase, B of A, Wells Fargo and other large banks an opportunity to correct their past mistakes.

January 27 -

Wells Fargo is reviewing its policy of giving retail bankers a day's notice before internal inspectors visit a branch.

January 24 -

Wells branch employees knew in advance when bank inspectors were coming; Goldman, Morgan Stanley and JPMorgan execs have sold nearly $100 million in stock during the Trump rally

January 24