Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

After yet another scandal, it's time for would-be Wells Fargo shareholders to decide: Is this a rare buying opportunity or has the bank lost its mojo?

August 1 -

Large banks like Wells Fargo have started using "cyber ranges" and "red teams" to respond to real cyberattacks on virtual versions of their real systems.

July 31 -

Republican efforts to repeal the Consumer Financial Protection Bureau's arbitration rule were dealt a significant blow Friday by another Wells Fargo scandal.

July 28 -

The bank forced hundreds of thousands of auto loan borrowers to take out insurance they didn't need, putting some into delinquency; a Russian man is arrested and charged in $4 billion money laundering scheme.

July 28 -

Wells Fargo's campaign to rebuild customer and shareholder trust just hit another bump, as the bank said it may have pushed thousands of car buyers into loan defaults and repossessions by charging them for unwanted insurance.

July 28 -

The new Citigold program for affluent customers is more than a product — it is the centerpiece of Citigroup's vision for the future, which will also rely on branch closures and sophisticated apps.

July 25 -

More and more FIs are adding videoconferencing at branches, but consumers might prefer to video-chat from their phones. Unlike with mobile banking, shirts and pants will likely be required.

July 24 -

Banks are adding videoconferencing at branches, but consumers might prefer to video-chat from their phones. Unlike with mobile banking, shirts and pants will likely be required.

July 24 -

The bank is drawing renewed scrutiny after a lawyer’s unauthorized release of sensitive client details for tens of thousands of accounts belonging to wealthy customers of its brokerage unit.

July 24 -

Outside counsel for Wells Fargo accidently sends files on wealthy customers to opposing lawyer in defamation case; White House wants agency’s consumer complaint database to be private.

July 24 -

The branch manager was terminated after she reported conduct by at least three private bankers working under her that she believed to be bank, wire and mail fraud.

July 21 -

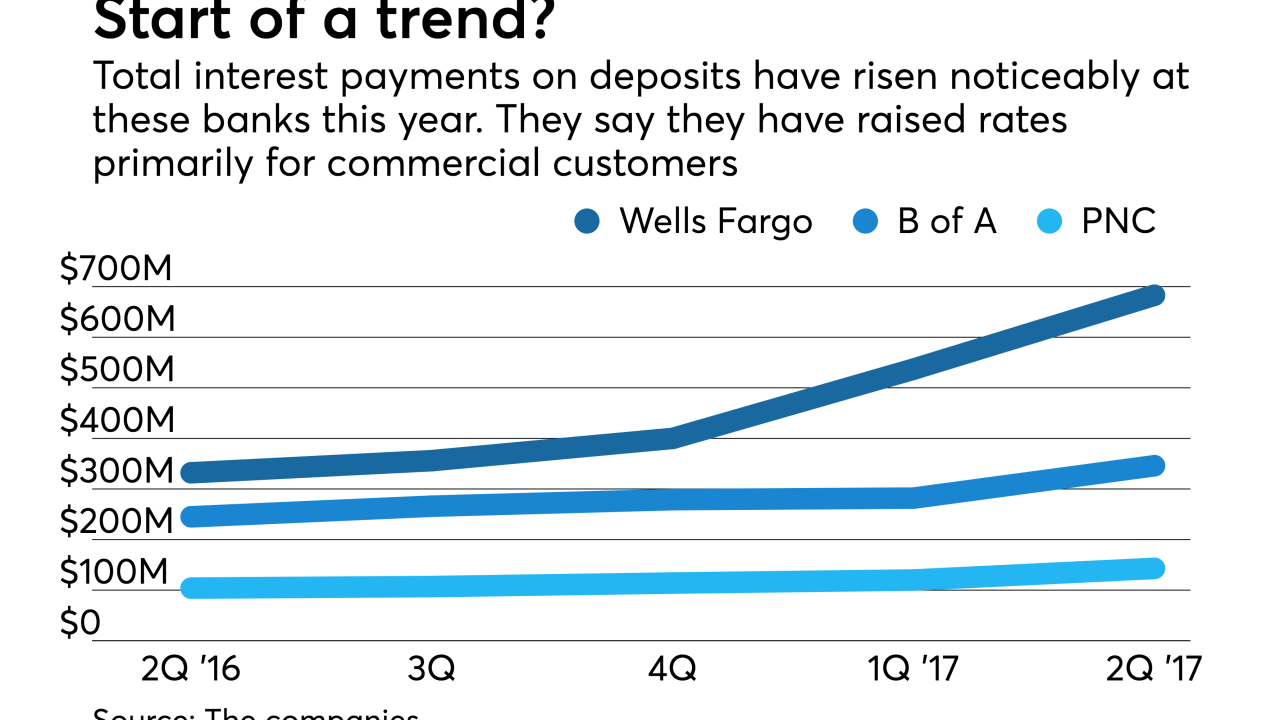

Now that the Federal Reserve has raised short-term rates four times in the past 18 months, all eyes are on deposit costs as banks seek to keep pricing low and fatten margins. But that effort is complicated by the fact that banks must prepare for the unwinding of the Fed's balance sheet and consumers' rapid adoption of mobile deposits.

July 21 -

Piecemeal settlement through mandatory arbitration masks widespread misconduct like Wells Fargo’s fake-accounts scandal. Class actions bring such systemic abuses to light, and should always be an option for consumer redress.

July 21 -

Because of the opaque nature of internet retailing and widely publicized data breaches, security concerns remain a pervasive gating factor to digital commerce. Key to countering this is providing consumers with the tools to monitor and control where their payment credentials are stored online.

July 20 -

The bank's new Control Tower app is designed to empower customers to track where their financial data is stored and to simplify their control over where it goes and what is done with it.

July 19 -

The bank’s once-vaunted bond trading unit reports its second bad quarterly performance in a row; Cordray tells OCC it’s too late to stop rule prohibiting mandatory arbitration.

July 19 -

In a sign of broader competition ahead, bigger banks are raising the interest they pay on deposits held by business customers. The big question is how hard will it be for banks to maintain margins and to stave off consumer demands for better rates.

July 18 -

Investors blame Washington gridlock, lowered expectations for price drop; Wells Fargo looks to narrow its focus as it jettisons some units.

July 17 -

The phony-sales scandal forced a reckoning over an organizational structure that had long encouraged autonomy for the bank’s various business units.

July 14 -

On the first big day of 2Q results, bankers said their investments in middle-market lending have started paying off. JPMorgan Chase and PNC have added commercial loan officers in new markets across the country.

July 14