Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

Banks may be hoping for a friendlier enforcement environment under the Trump administration, but legal experts suggest a lighter touch will probably not extend to Wells Fargo.

April 10 -

CEO Jes Staley is investigated by British authorities for trying to unmask a bank whistleblower and will take a pay hit; ISS is second consultant to call for voting against Wells directors.

April 10 -

The Office of the Comptroller of the Currency's top examiner at Wells Fargo was removed last month, according to Reuters.

April 7 -

The company took aim at Institutional Advisory Services, which recommended on Friday that shareholders vote against 12 of the company’s 15 board members.

April 7 -

Though statistically women have trouble getting small business loans, Square's granting more than half its loans to women; latest numbers show only one in four bank senior execs are female.

April 6 -

CFPB director accused of being "asleep at the wheel" during the Wells Fargo scandal; consumers and retailers both reluctant to use Apple's mobile payment service.

April 6 -

Such reinstatements are unusual, and could signal a more aggressive approach by the government to protecting whistleblowers in the financial services sector.

April 5 -

The publication won the Neal award for best news coverage and Washington Bureau Chief Rob Blackwell received the prestigious Timothy White award for editorial leadership.

April 5 -

Access to banking information ensures advisors can perform holistic planning, fintech firms say.

April 5 -

Titi Cole succeeds longtime executive Jerry Enos.

April 5 -

The battle over screen scraping seems to be subsiding into a series of agreements between banks and fintechs using open APIs.

April 4 -

The executive tasked with rebuilding trust in the retail bank discusses how employees reacted to its new incentive pay plan, why Wells stopped calling its branches "stores," how it now prevents salespeople from impersonating customers, and more.

April 4 -

The U.S. government ordered Wells Fargo to reinstate a former bank manager who was fired after reporting suspected illegal behavior to his superiors and a company hotline.

April 3 -

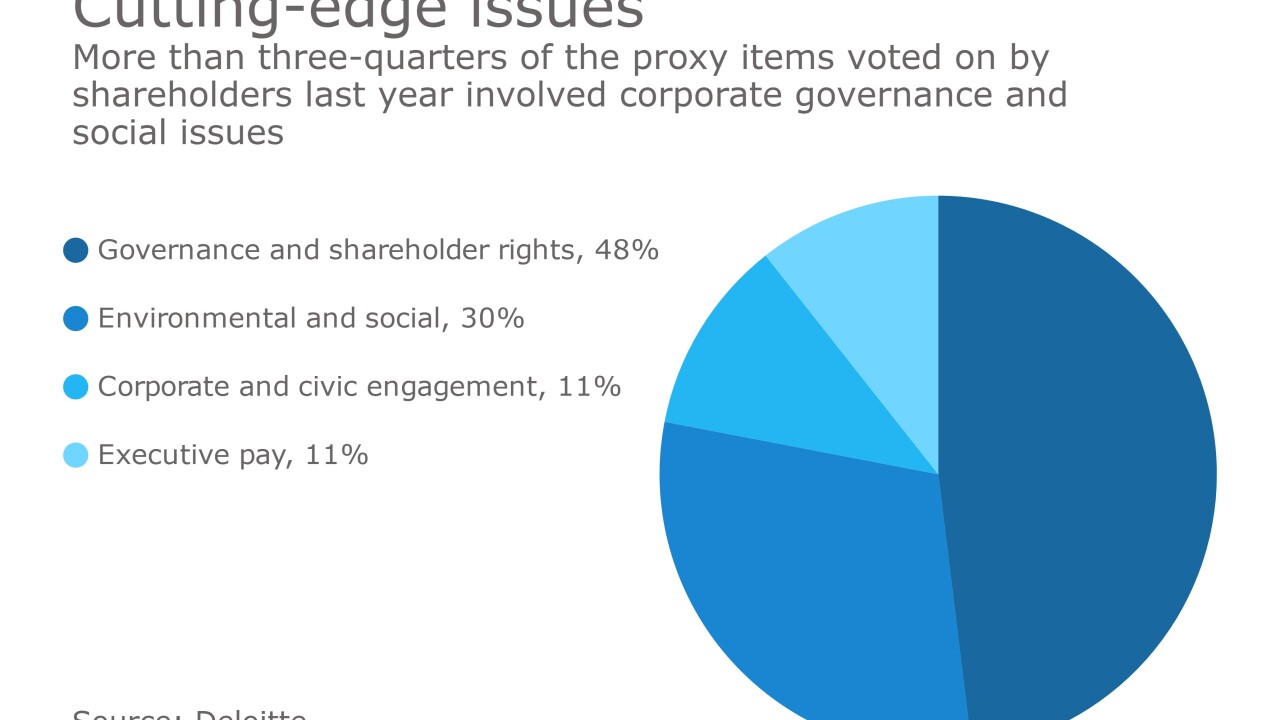

Investors concerned about the impact on banking of climate change, the pay gap and ethics matters are pushing back against a coalition of the heads of the biggest U.S. banks and other public companies that wants to limit small investors’ access to proxy ballots.

March 30 -

Wells Fargo & Co. is expanding its ExpressSend remittance payout network in India to include Axis Bank and, beginning next month, expanding a free-transfer promotion previously available only for those sending at least $500.

March 30 -

Low scores make it harder for banks to get regulatory OKs to expand, but Wells is in retrenchment mode anyway.

March 29 -

Digital currency proponents now pin their hopes on a bitcoin futures contract; bank reaches $110 million settlement with customers over phony accounts but gets "needs to improve" CRA rating.

March 29 -

Proposals to split the chairman and CEO roles at banks have rarely succeeded. But new developments — including a proposal to require separate roles for the next generation of managers — are helping concerned shareholders slowly make inroads.

March 28 -

Wells Fargo engaged in an "extensive and pervasive pattern" of discriminatory and illegal lending practices for years, the OCC said in slashing a key rating of how the bank serves communities.

March 28 -

The settlement, which requires judicial approval, will cover customers' fees and other costs related to about 2 million unauthorized accounts.

March 28