Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

The battle over screen scraping seems to be subsiding into a series of agreements between banks and fintechs using open APIs.

April 4 -

The executive tasked with rebuilding trust in the retail bank discusses how employees reacted to its new incentive pay plan, why Wells stopped calling its branches "stores," how it now prevents salespeople from impersonating customers, and more.

April 4 -

The U.S. government ordered Wells Fargo to reinstate a former bank manager who was fired after reporting suspected illegal behavior to his superiors and a company hotline.

April 3 -

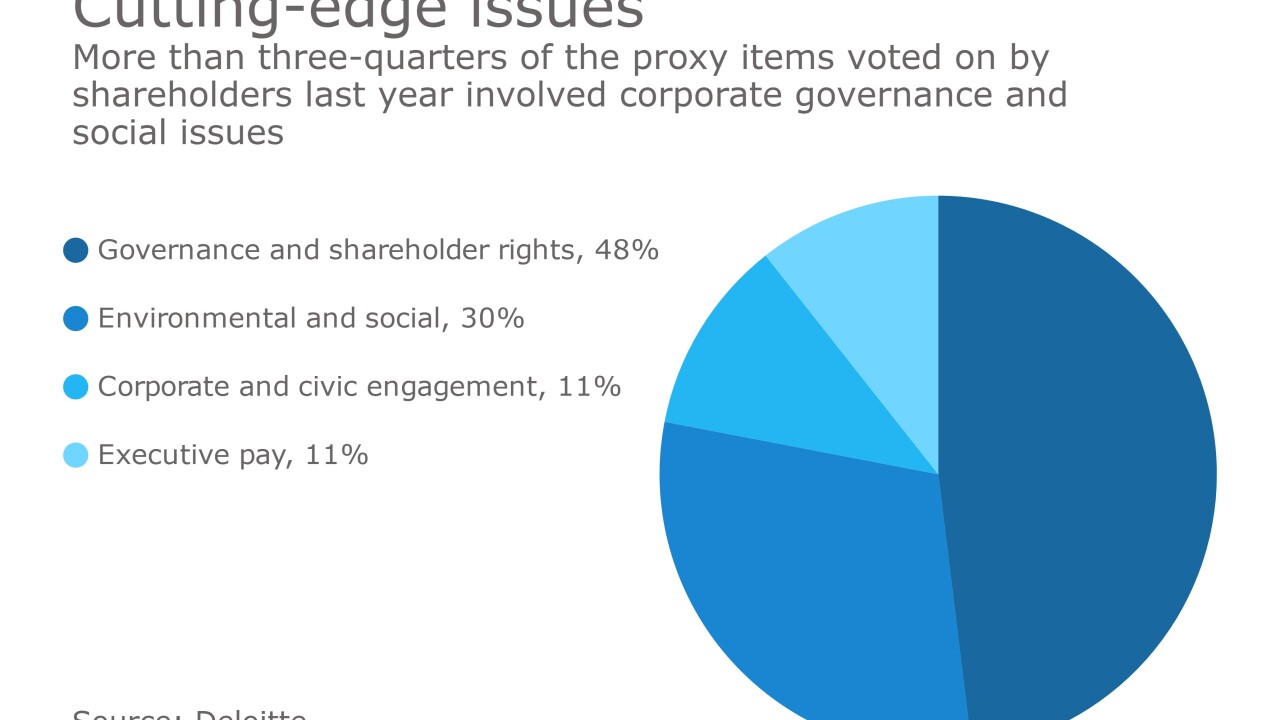

Investors concerned about the impact on banking of climate change, the pay gap and ethics matters are pushing back against a coalition of the heads of the biggest U.S. banks and other public companies that wants to limit small investors’ access to proxy ballots.

March 30 -

Wells Fargo & Co. is expanding its ExpressSend remittance payout network in India to include Axis Bank and, beginning next month, expanding a free-transfer promotion previously available only for those sending at least $500.

March 30 -

Low scores make it harder for banks to get regulatory OKs to expand, but Wells is in retrenchment mode anyway.

March 29 -

Digital currency proponents now pin their hopes on a bitcoin futures contract; bank reaches $110 million settlement with customers over phony accounts but gets "needs to improve" CRA rating.

March 29 -

Proposals to split the chairman and CEO roles at banks have rarely succeeded. But new developments — including a proposal to require separate roles for the next generation of managers — are helping concerned shareholders slowly make inroads.

March 28 -

Wells Fargo engaged in an "extensive and pervasive pattern" of discriminatory and illegal lending practices for years, the OCC said in slashing a key rating of how the bank serves communities.

March 28 -

The settlement, which requires judicial approval, will cover customers' fees and other costs related to about 2 million unauthorized accounts.

March 28 -

With a "needs to improve" rating, Wells Fargo is now subject to a wide range of regulatory restrictions on things like branch openings and M&A.

March 28 -

Community banks, big commercial banks and Wall Street investment houses are finding common ground in small-business loan funds that help Main Street, minimize potential losses on credit extended to young companies and sometimes lead to new business prospects.

March 27 -

As banks work to integrate their mobile apps with their physical channels, the march toward universal cardless ATM technology continues.

March 27 -

By bending over backward when borrowers trade in an older car for a new one, lenders are said to have embarked down an unsustainable path. The warning, by Moody’s, adds to concerns about credit quality in auto lending.

March 27 -

By bending over backward when borrowers trade in an older car for a new one, lenders are said to have embarked down an unsustainable path. The warning, by Moody’s, adds to concerns about credit quality in auto lending.

March 27 -

Regulators want to make rules easier for small banks; auto loan defaults rise while used-car prices fall.

March 22 -

The lender will begin an ad campaign in mid-April with the tag line "Building Better Every Day," company employees were told Tuesday.

March 21 -

So-called performance-share units are pushing aside stock options as the preferred long-term incentive pay for bank executives. Many investors and regulators fear that options can encourage reckless conduct and have other shortcomings, though options still have supporters.

March 21 -

The scandal involving Wells Fargo that surfaced last year shows the U.S. banking industry still has work to do on improving its culture, Federal Reserve Bank of New York President William Dudley said.

March 21 -

The grandson of the oil titan and the former head of Chase Manhattan passes away at 101; Wells reports biggest drop in new account openings since the scandal.

March 21