-

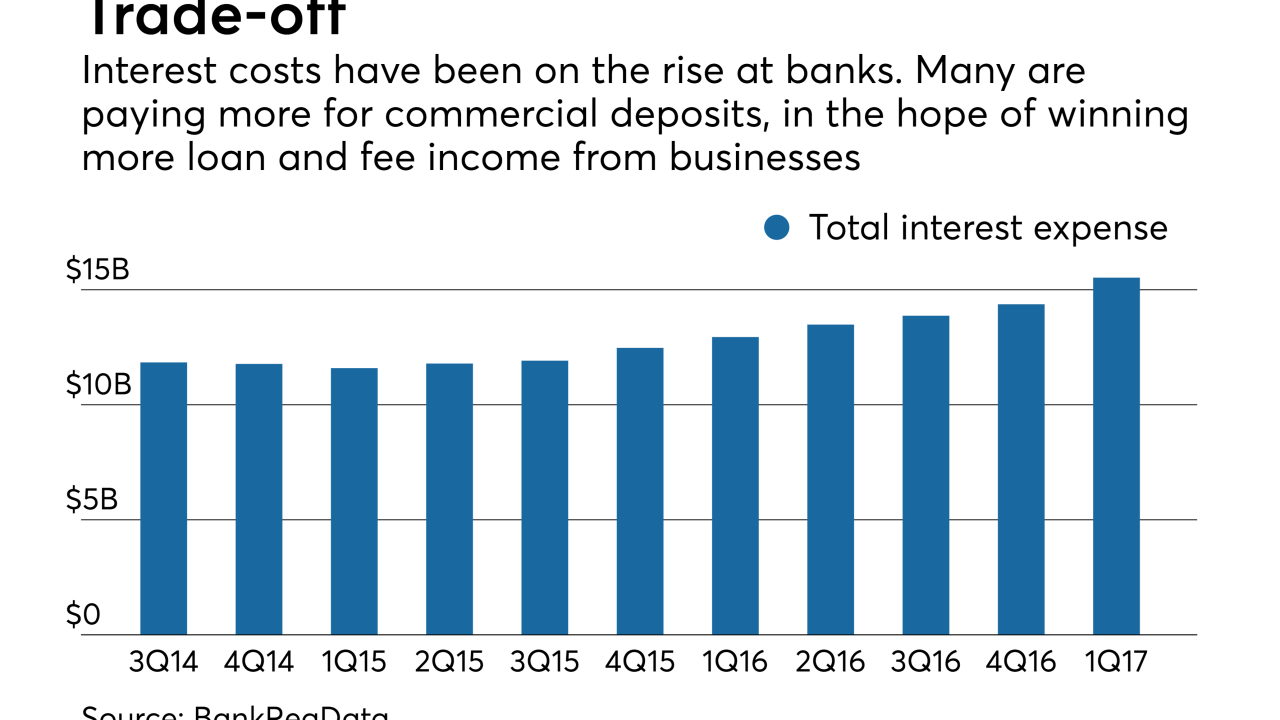

Many banks are adopting an “it takes money to make money” approach, paying more interest on deposits in exchange for loan growth, fee income and customer retention.

August 7 -

The online lender said it is on track to hit its goal of becoming profitable by yearend. It also extended a partnership agreement with JPMorgan Chase.

August 7 -

It is the latest of several popular apps to close down in recent weeks.

August 4 -

The online lending platform Kabbage announced Thursday it has raised $250 million from the Japanese telecom giant SoftBank, marking its largest equity fundraising round to date.

August 3 -

So-called transitional lending has traditionally been kept on balance sheet; but it’s become attractive to bundle the loans for transactions called (take a deep breath) commercial real estate collateralized loan obligations. Can investors stomach the features these deals sported before the crisis?

August 2 -

With the environment in Washington favoring deregulation, banks are pushing regulators to let them back into the payday lending game. They should know better.

August 2 Center for Responsible Lending

Center for Responsible Lending -

JPMorgan Chase is among four banks sued by a trustee for investors in the debt of Millennium Health LLC, alleging the lenders failed to inform them of a federal probe into the billing practices of the borrower.

August 2 -

Insurers are seeing modest gains in market share as banks, facing increased scrutiny from regulators, lightly tap the brakes.

August 1 -

The Fed’s quarterly Senior Loan Officer Opinion Survey found that demand decreased for both commercial and industrial and commercial real estate loans.

July 31 -

The app, formerly known as BillGuard and a favorite of many fintech insiders, helped users protect their identities and monitor their credit scores.

July 31 -

Efforts to repeal a Dodd-Frank mandate for lenders to report data on small-business applicants — including race and ethnicity — overlook the benefits of the provision to both communities of color and banks.

July 28 The Greenlining Institute

The Greenlining Institute -

Profits rose 20% at the Texas bank, but net interest margin growth last quarter, and the bank’s margin outlook for the rest of this year, disappointed analysts and investors.

July 27 -

The Riverwoods, Ill., company is trying to assure Wall Street that its higher chargeoff rates signal a return to normalcy, rather than a cause for alarm.

July 27 -

The Blairsville, Ga., bank is in growth mode with strong second-quarter lending performances and two deals in the works, but its provision for loan losses was described as too low in one research note.

July 26 -

CircleUp is offering lines of credit to early-stage consumer brands, which can often only get financing at high interest rates.

July 26 -

The Miami Lakes company’s chargeoffs of medallion loans increased fivefold, but profits rose thanks to gains in C&I, CRE and other types of loans.

July 26 -

The Tulsa, Okla., company reported loan growth in all categories, including a 56% increase in personal loans.

July 26 -

The Salt Lake City company also benefited from increases in investment securities and several large loan recoveries during the quarter.

July 25 -

The New York company, which is preparing to buy Astoria Financial, reported year-over-year increases in commercial-and-industrial and commercial real estate loans.

July 25 -

MPOWER Financing announced a deal Tuesday with Bank of Lake Mills in Wisconsin that will enable the Washington, D.C.-based company to lend to students in all 50 states.

July 25