-

Former Equifax CEO and Wells Fargo chief both expected to issue mea culpas to Congress; Goldman apparently likes digital currency.

October 3 -

The workers who have been brought back do not include any of the more than 5,000 employees who were fired for alleged misconduct, according to the company.

October 2 -

Though many of its policies were in place before news of the Equifax breach came out, Mountain America Credit Union is doubling down on its approach to protecting member data.

October 2 -

Mastercard is unveiling an anti-fraud tool that’s been in development for more than three years, bringing a new way to pinpoint cards and accounts at the highest risk of fraud following data breaches.

October 2 -

The week of Oct. 2 is shaping up to be a significant one for the financial services industry on Capitol Hill, as lawmakers grill the top executives of Equifax and Wells Fargo, as well as the top regulator of Fannie Mae and Freddie Mac.

September 29 -

Ocwen Financial reached a settlement with 10 states under which it can't acquire servicing rights for eight months but will not face any financial penalties.

September 29 -

The groups argue that the CFPB did not properly conduct a cost-benefit analysis of the rule banning mandatory arbitration agreements and that the final product will harm, not help, consumers.

September 29 -

Both former credit union employees are prohibited from participating in the affairs of any federally insured financial institution.

September 29 -

Readers comment on the ripple effects of the Equifax breach, who benefits from the CFPB's final arbitration rule, gender-related issues in financial services, and more.

September 29 -

Washington Federal is the latest bank to pull an application after being flagged for insufficient Bank Secrecy Act compliance.

September 29 -

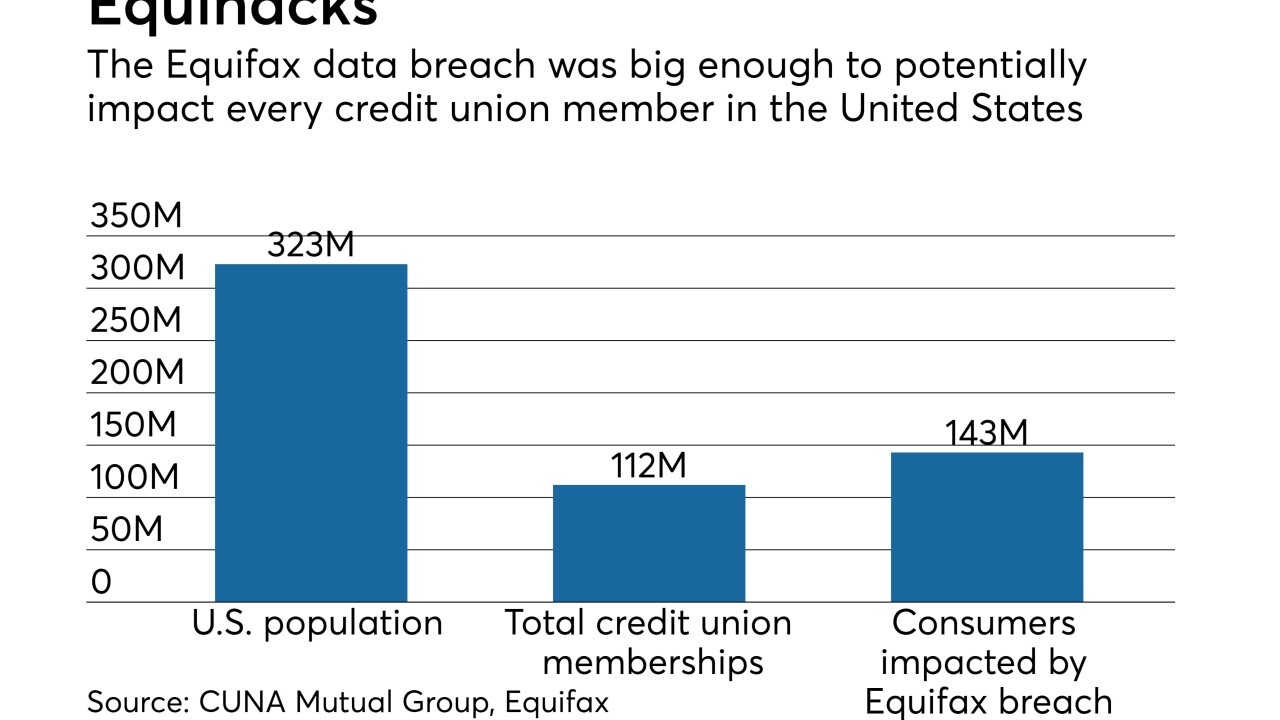

Equifax's data breach may be the most serious, given that it covered 143 million consumers and involved reams of confidential information, but it wasn't the largest. Following are the biggest to date.

September 29 -

Acting Comptroller of the Currency Keith Noreika affirmed Thursday that the agency’s fintech charter, if implemented, could be granted to commercial firms like Walmart or Google.

September 28 -

Yes, the credit bureau goofed badly on data security, and it proved to be worse at crisis management. But other companies have been just as sloppy with cyber defenses, and business and government leaders should have tackled these problems long before now.

September 28 -

A panel of experts at this year's ACUMA conference says credit unions must find ways to collaborate while still remaining innovative.

September 27 -

Wells Fargo is extending a 6-year-old fight with a whistleblower, despite a government order to immediately reinstate the former employee.

September 27 -

The embattled Smith may lose severance benefits, depending on firm’s probe into data breach; Clayton grilled about why the agency took so long to act after Edgar hack.

September 27 -

The accounting firm says only a "very few" clients were affected by the cyberattack; former CEO Mike Cagney's wife, the lender's chief tech officer, is leaving.

September 26 -

The Consumer Financial Protection Bureau’s final rule on arbitration clauses may be bad news for alleged corporate wrongdoers like Equifax and Wells Fargo, but surely for the victims of such wrongdoing — and for consumers, generally — it is good news indeed.

September 26 Dean Clancy

Dean Clancy -

The auditing and consulting firm said Monday that it’s currently informing the clients affected and has notified governmental authorities after it became aware of the incident.

September 25 -

Ironically, the credit bureau’s rise was built on promise to safeguard customers’ most sensitive information; bank to build global ops center in Warsaw.

September 25