-

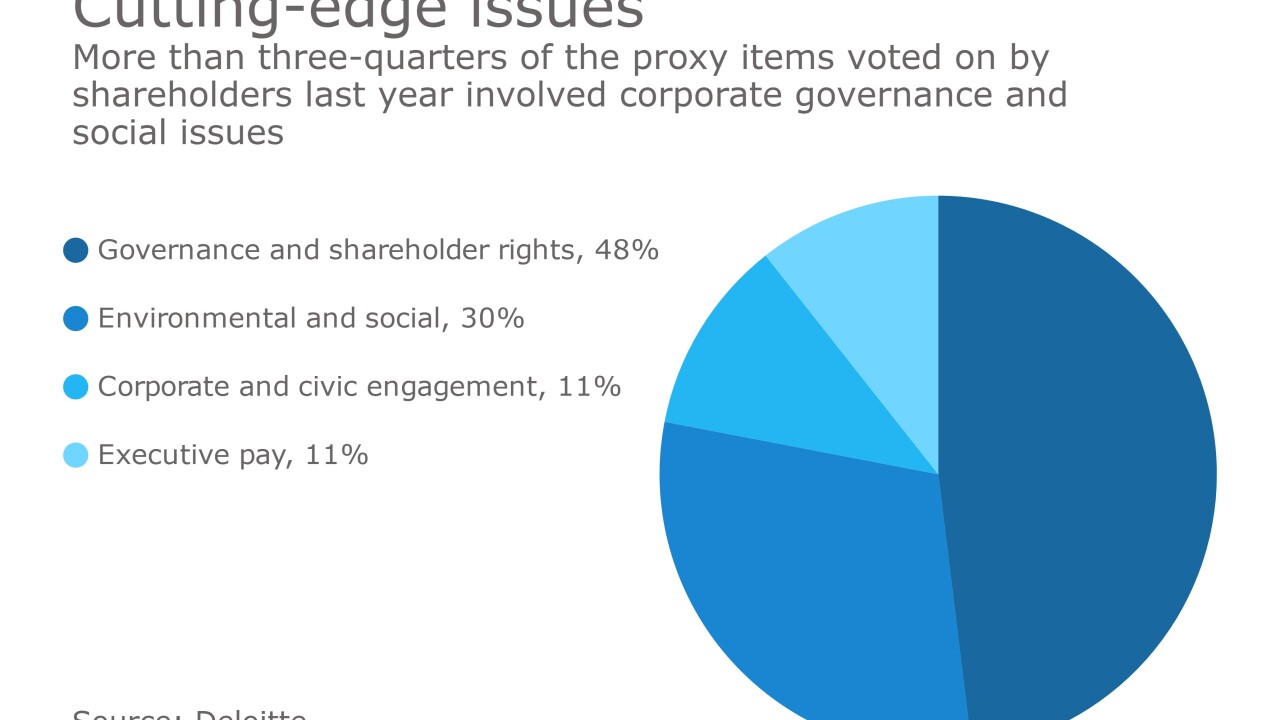

Investors concerned about the impact on banking of climate change, the pay gap and ethics matters are pushing back against a coalition of the heads of the biggest U.S. banks and other public companies that wants to limit small investors’ access to proxy ballots.

March 30 -

Mid Penn agreed to pay $59 million for Scottdale Bank in a deal that is expected to close in the third quarter.

March 29 -

The New Jersey company added a representative of Blue Harbour Group in Connecticut to its board.

March 29 -

First Bank, based in New Jersey, will pay about $27 million for Bucks County Bank in a deal that is expected to close in the third quarter.

March 29 -

James Lockhart, former director of the FHFA, is replacing Wilbur Ross, who resigned when he became Commerce secretary, on the New Jersey company's board.

March 29 -

Proposals to split the chairman and CEO roles at banks have rarely succeeded. But new developments — including a proposal to require separate roles for the next generation of managers — are helping concerned shareholders slowly make inroads.

March 28 -

Creative growth strategies are helping banks with $10B to $50B of assets — including Webster and TCF — improve profitability. These ‘tweeners’ deal with tougher regulations than smaller competitors without the scale larger ones have to absorb the expense.

March 27 -

The more vocal millennial generation is pushing companies like Bank of America to redefine diversity in the workplace to include more freedom of expression.

March 24 -

The industry should not discourage credit unions from having a full platter of choices when it comes to advocacy.

March 24

-

BMO recently won a diversity award for reaching its goal of having women in 40% of senior management jobs, and CEO Bill Downe argues equal treatment of employees will carry over to fair treatment of customers and create long-term profits for shareholders.

March 23 -

Bankers, directors and other large investors are unloading millions of shares as bank stocks stay close to all-time highs.

March 22 -

So-called performance-share units are pushing aside stock options as the preferred long-term incentive pay for bank executives. Many investors and regulators fear that options can encourage reckless conduct and have other shortcomings, though options still have supporters.

March 21 -

Jim Rosenthal previously served as chief operating officer at the Wall Street investment bank. He joins the board of an online lender that has recorded losses in five straight quarters.

March 21 -

The latest numbers underscore the extent of the challenge that the megabank faces in restoring its once-clean public image.

March 20 -

Banks like TD and U.S. Bancorp are suddenly taking public shots from current and former employees critical of their sales practices, a sign that the industry has not put behind it the questions raised months ago by the phony-accounts scandal at Wells.

March 17 -

H. Palmer Proctor has been the Atlanta company's president since 2004.

March 17 -

The advent of more choice for credit unions when it comes to trade groups appears to be a dialogue few industry leaders want to tackle.

March 17 Credit Union Journal

Credit Union Journal -

The Fed said it will conduct extensive reviews only of deals that create banks with assets of $100 billion, replacing the prior mark of $25 billion. The disclosure was included in the Fed's approval of People's United's purchase of Suffolk Bancorp.

March 17 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

March 17 -

If others follow Del-One's lead and start league shopping instead of staying in-state, collaboration in the cooperative industry could take a hit, some worry.

March 16