-

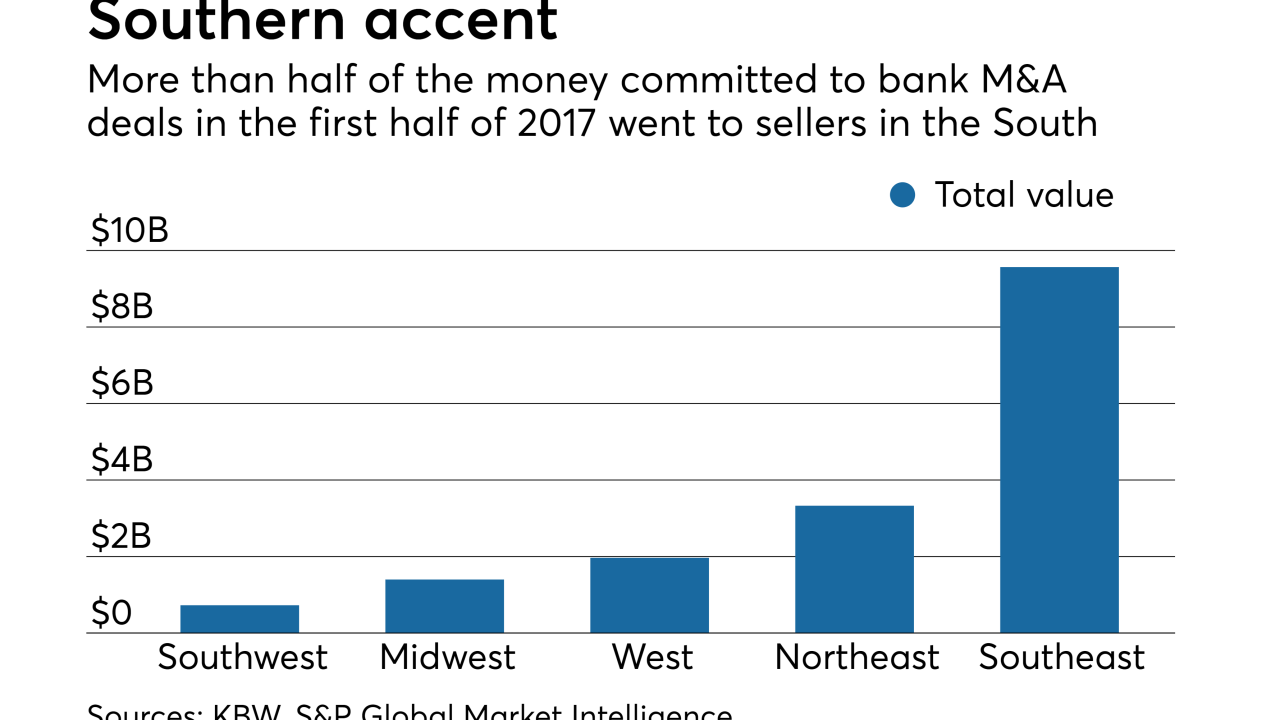

While industry consolidation remains slow compared with previous years, certain regions are humming along with strong volume and improved pricing. Here’s a look at each region based on June 30 data from KBW and S&P Global Market Intelligence.

July 14 -

AERO FCU, Truliant FCU join for debit card processing, call center support.

July 14 -

First Horizon reported lower fee income in the second quarter. The company said it is making progress planning for its pending purchase of Capital Bank Financial.

July 14 -

First Citizens is pressuring KS Bancorp to sell even though the banks' operations overlap in many markets in eastern North Carolina.

July 13 -

The North Carolina company could issue $200 million in new securities over time to fund acquisitions and other investments.

July 13 -

The region is responsible for a third of all bank sellers — and more than half of the industry's overall deal volume.

July 10 -

The North Carolina company's purchase of Chattahoochee Bank will add a branch and loan production office to its existing operations in northern Georgia.

June 28 -

The Georgia bank will pay $124 million for Four Oaks Fincorp, buying a bank with a large operation in Raleigh, N.C.

June 27 -

Pinnacle Financial Partners closed in on $20 billion in assets by buying BNC. It now has to integrate the North Carolina bank, while finding ways to boost profit and adapt to increased regulatory burden.

June 16 -

Having managed five credit unions even while serving as CEO of one, the 92-year-old is believed to have set a record for length of service.

June 16 -

Casey Crawford, head of the rapidly growing Movement Mortgage, recently recapitalized First State Bank in Danville, Va., with his own money.

June 14 -

The company agreed to pay $162 million to buy First South Bancorp in Washington, N.C. It is the fifth time this year that a bank in North Carolina has agreed to be sold to a buyer from another state.

June 12 -

His decades-long career in credit unions spans three different state leagues and was proceeded by 21 years of military service.

May 24 -

The 2015 written agreement had required Four Oaks to improve corporate governance.

May 10 -

A tech JV between Live Oak and First Data aims to do for small-business deposits what the bank previously did for lending.

May 10 -

First Horizon CEO Bryan Jordan explains why he thinks policymakers will change the $50 billion asset cutoff and justify the regional bank's big acquisition.

May 4 -

The acquisition will make the Tennessee company one of the biggest banks in the Southeast, with assets of more than $40 billion.

May 4 -

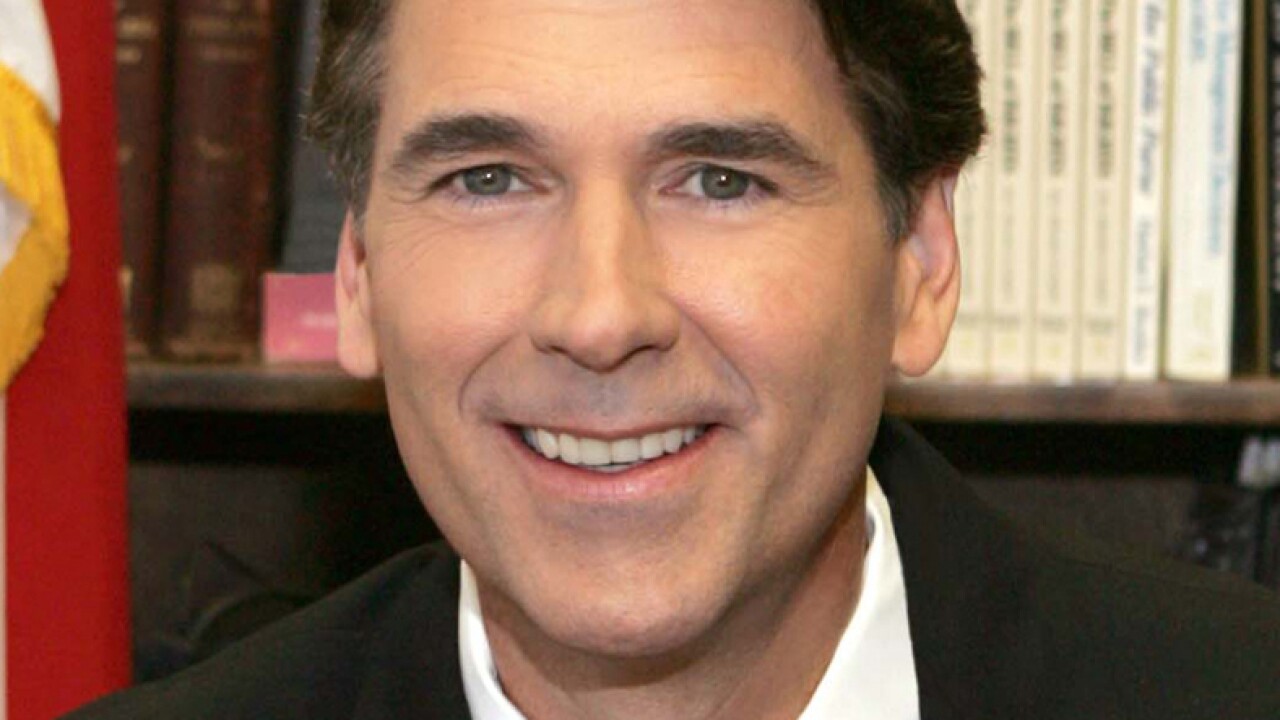

Richard Moore, CEO of First Bancorp in North Carolina, believes he can unlock more shareholder value through acquisitions and by taking advantage of disruption elsewhere.

May 3 -

Entegra Financial disclosed that it held First NBC subordinated debt. An impairment charge tied to the bank's failure will lower Entegra's first-quarter profit by $441,000.

May 3 -

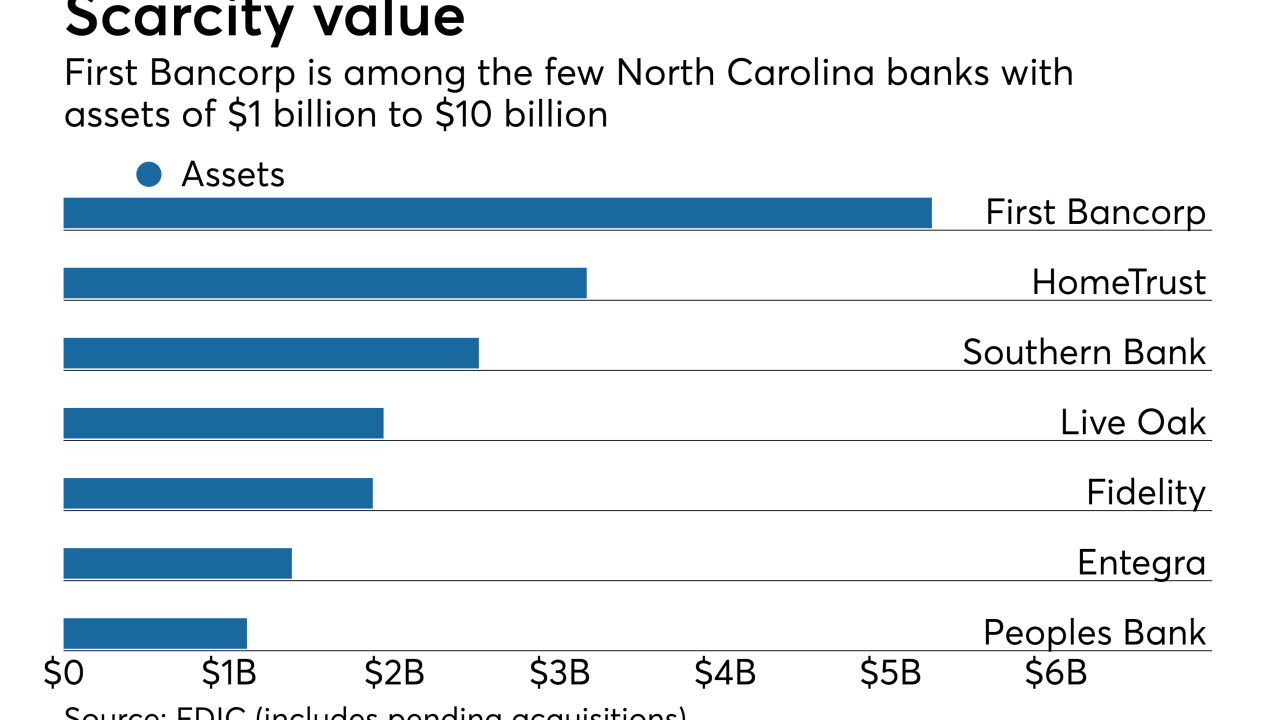

First Bancorp has emerged as one of the few consolidators in North Carolina at a time when many other banks in the state have opted to sell.

May 1