-

The Tennessee branches are being sold as part of First Horizon's deal to buy Capital.

November 20 -

The company has reapplied to buy Civic Bank more than a year after a regulatory snag forced it to put the deal on ice.

November 13 -

CapStar Financial is suing an investor on claims he misled other shareholders and is trying to skirt bank holding company laws.

November 2 -

Studio Bank aims to become the first de novo in Nashville in nearly a decade.

August 28 -

Lynn Harton was finally named CEO of United Community Bank after a five-year apprenticeship, though Jimmy Tallent remains CEO of the parent company. The executives have long touted an ability to bounce ideas off each other as a reason for United's success.

August 17 -

The Tennessee company reported higher profit that reflected its June purchase of BNC Bancorp and nearly $670 million of organic loan growth during the second quarter.

July 19 -

Buying Capital Bank puts the company on a fast track for more regulatory scrutiny. Executives are identifying ways to boost revenue and taking other measures so it can handle the change.

July 14 -

First Horizon reported lower fee income in the second quarter. The company said it is making progress planning for its pending purchase of Capital Bank Financial.

July 14 -

Current EVP Martin Bradley will take the helm on Sept. 1.

June 20 -

Pinnacle Financial Partners closed in on $20 billion in assets by buying BNC. It now has to integrate the North Carolina bank, while finding ways to boost profit and adapt to increased regulatory burden.

June 16 -

Lending and managing money for recording artists and labels can be a profitable niche. But volatile income streams, intellectual property challenges and business model upheaval can trip up the inexperienced.

June 7 -

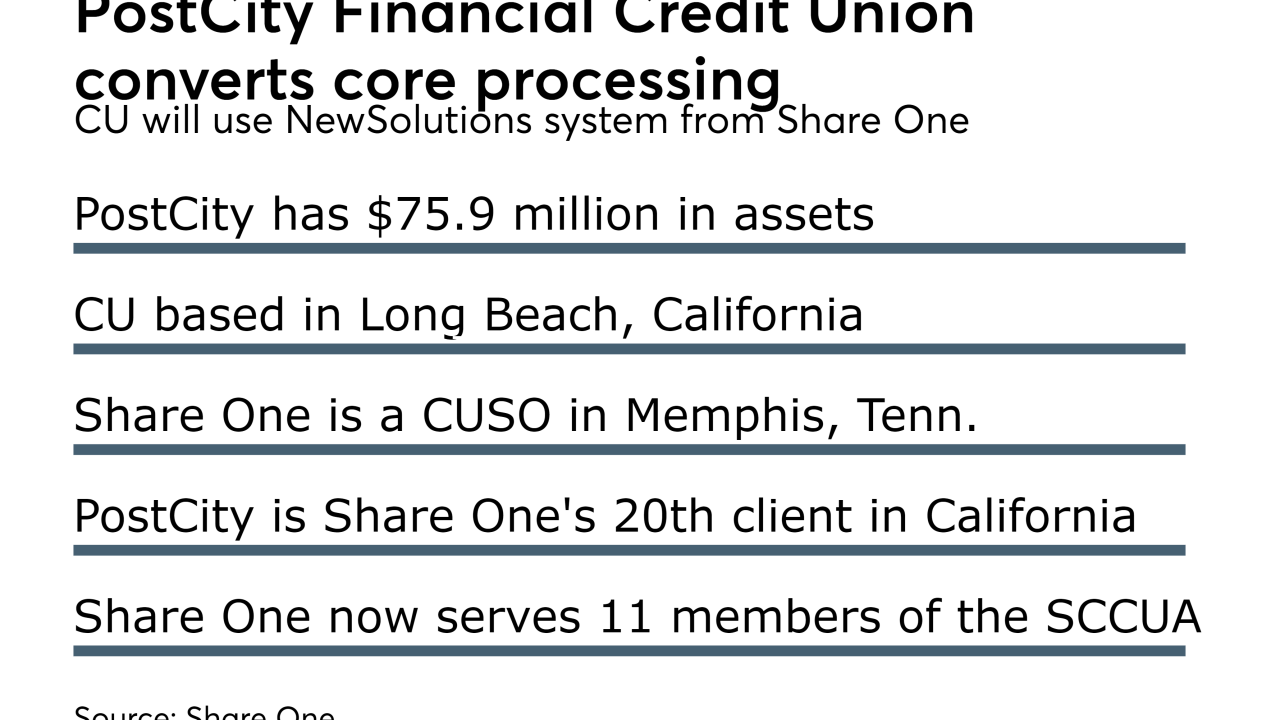

Credit union will switch core processors in October, becoming the 21st Share One client in California.

May 31 -

The company was set to sell a 24% stake in itself to buy two Tennessee banks but has restructured the arrangement to avoid a potential conflict cited by a regulator.

May 30 -

The Tennessee bank has agreed to pay nearly $85 million for Capstone Bancshares in Alabama.

May 23 -

First Horizon CEO Bryan Jordan explains why he thinks policymakers will change the $50 billion asset cutoff and justify the regional bank's big acquisition.

May 4 -

The acquisition will make the Tennessee company one of the biggest banks in the Southeast, with assets of more than $40 billion.

May 4 -

The new name reflects the seven cooperative principles, including cooperation among cooperatives.

May 2 -

Christy Romero, the special inspector general for the Troubled Asset Relief Program, and two other government entities were involved in a probe that led Lamar Cox, former chief operating officer at Tennessee Commerce Bank, to plead guilty to misleading the FDIC.

April 25 -

The company has hired an investment bank to help it consider strategic alternatives, which could also include recapitalizing.

April 20 -

Credit union will switch May 1, becoming the 20th Share One client in California.

April 18