Community banking

Community banking

-

Bank of Austin still needs approval from the Federal Deposit Insurance Corp., though organizers remain hopeful it can open this summer.

May 9 -

The post-election rally in banking stocks has given certain buyers the ability to make acquisitions that would add to tangible book value, perhaps making it easier for them to pursue more deals.

May 8 -

With donations if time, money and supplies, credit unions are making a difference for organizations that make a difference in the lives of those they serve.

May 8 -

Five Star Bancorp in California is the latest bank to work with a marketplace lender on referrals. The move comes as the SBA programs have record volumes while concerns linger about banks working with third parties.

May 5 -

The $71 million transaction is the latest in a series of acquisitions by Seacoast in recent months.

May 5 -

The Arizona company said Kenneth Vecchione would be a candidate to eventually replace CEO Robert Sarver.

May 4 -

From costume contests to memes and high-quality original videos, credit unions found all sorts of ways to celebrate the "Star Wars" series today.

May 4 -

The acquisition will make the Tennessee company one of the biggest banks in the Southeast, with assets of more than $40 billion.

May 4 -

Helping kids, rewarding those who save, promoting community and other ways credit unions are giving back to those they serve.

May 3 -

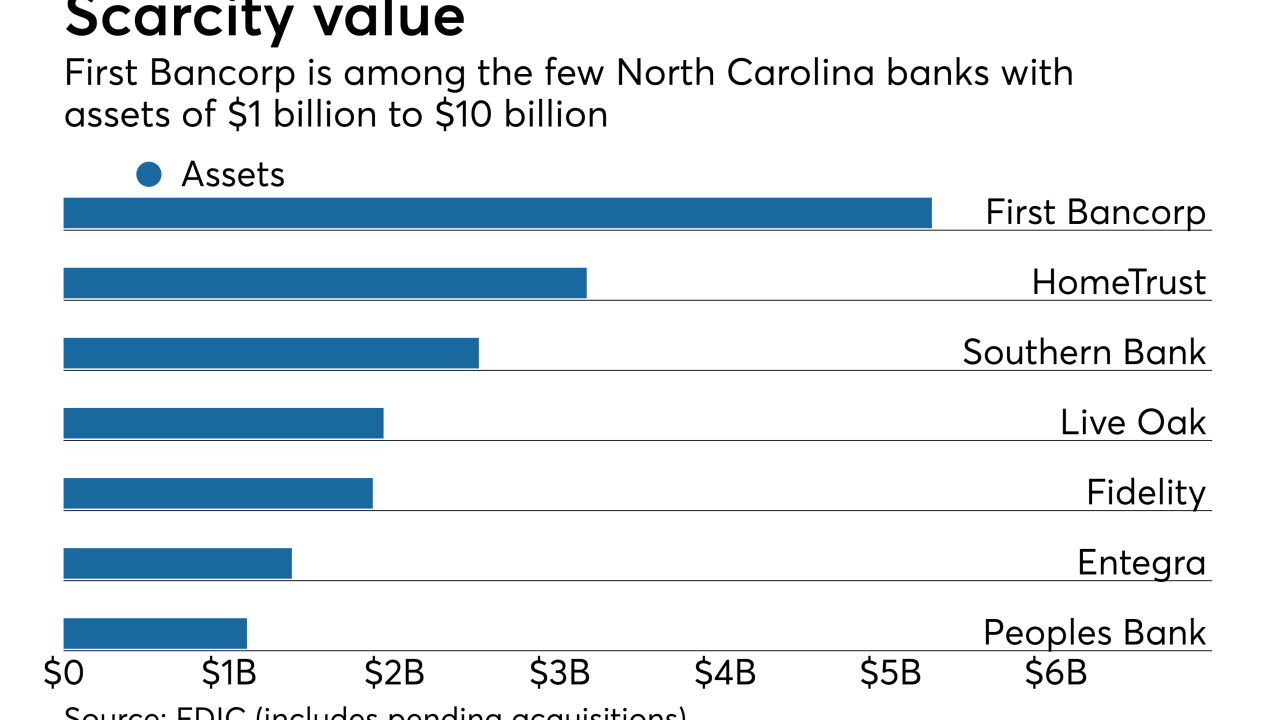

Richard Moore, CEO of First Bancorp in North Carolina, believes he can unlock more shareholder value through acquisitions and by taking advantage of disruption elsewhere.

May 3 -

Greig, who orchestrated FirstMerit's sale to Huntington Bancshares, joined Opus' board last month.

May 3 -

The company's earnings fell 20% from a year earlier, reflecting $5 million in restructuring charges and a higher loan-loss provision.

May 3 -

Entegra Financial disclosed that it held First NBC subordinated debt. An impairment charge tied to the bank's failure will lower Entegra's first-quarter profit by $441,000.

May 3 -

Rebeca Romero Rainey, a third-generation community banker who rose to executive leadership in her early 20s, has been tasked to lead the Independent Community Bankers of America at a pivotal time.

May 2 -

The company, which delisted from the Nasdaq in 2005, is looking to raise up to $64 million through an initial public offering.

May 2 -

The Mississippi company said Mitchell Waycaster will succeed Robin McGraw in May 2018.

May 2 -

Cam Fine, the longtime CEO of the Independent Community Bankers of America, is set to announce plans to retire next year, handing the reins to a community banker.

May 2 -

Blockchain technology requires major change in people and processes and smaller banks need to prepare, according to Joe Dewey, an attorney at Holland & Knight and author of a new book about distributed ledger technology.

May 2 -

During a meeting with more than a hundred community bankers on Monday, Trump administration officials made it clear they favored a system with different rules for small and big banks.

May 1 -

Here's the latest look at how credit unions are making a major difference in the communities they serve.

May 1