The Philadelphia-based bank's parent company, Republic First Bancshares, had been roiled by a yearslong proxy battle involving activist investors groups and its former CEO.

-

In the inaugural iteration of American Banker's news quiz, test your knowledge on top articles covering the legal battles of the Consumer Financial Protection Bureau, new technology testing at JPMorgan Chase, earnings season and more.

April 26 -

The former head of the Consumer Financial Protection Bureau resigned Friday after the troubled rollout of the Free Application for Federal Student Aid led some House Republicans to call for his resignation.

11h ago -

-

The state's comptroller of public accounts is one of several notable non-depositories with access to the Fed's payments system, along with the Chicago Mercantile Exchange and the Tennessee Valley Authority. So why do they have accounts while some neobanks don't?

10h ago -

The San Antonio-based bank said that loan growth, fueled in part by its expansion in key Texas markets, may compensate for pressure on deposits. It slashed the number of rate cuts it expects this year from five to two.

April 26

American Banker's Most Influential Women in Payments share their views on artificial intelligence, hybrid offices, real-time payments and more.

To protect their own talent pipeline, financial companies need to make sure that they're not only protecting the entry-level roles that AI threatens to take over, but getting the enthusiastic buy-in of the people most likely to be affected, according to experts from Fiserv, Segpay and Featurespace.

Ambitious women who feel trapped in their roles sometimes find themselves competing against others with the same goals. An effective way to advance may require stepping off the most obvious path, according to executives sharing their personal experiences at American Banker's Payments Forum.

Banks, payment companies, mortgage lenders and insurance providers are racing to seize an advantage from generative artificial intelligence. Some have been especially aggressive in deciding which workflows — or entire jobs — can be handed off to AI.

The first credit unions enrolled in the Federal Reserve's FedNow instant payments platform say it will fundamentally change the way they serve consumers and businesses across multiple categories.

Multifunction wallet apps will support shopping, loyalty, paying at the pump or EV charging station and crypto asset management, challenging the roles of U.S. financial institutions.

Visa, Mastercard and Global Payments discuss impacts on customer service, web content, security and more.

This year 90 banks made American Banker's 11th annual Best Banks to Work For ranking. The leaders of these institutions explain what it takes to be an employer of choice.

The smallest banks made up more than half of American Banker's Best Banks to Work For ranking this year.

Two dozen institutions fell into this midtier asset category for American Banker's Best Banks to Work For ranking this year.

2023 proved to be a rocky year for large regional banks. But under CEO Bill Demchak's guidance, the Pittsburgh-based company has navigated the turmoil better than many of its peers.

OFG Bancorp's CEO José Rafael Fernández has weathered tough times during Puerto Rico's economic downturn. Now he is hopeful that his bank can seize on the better times ahead.

As CEO, Gary Fukuroku has helped turn the Hawaiian-based institution into one of the largest in the state and has raised significant funds to help those affected by this year's wildfires.

Small Business Administration lending is an arena where community banks and nonbanks compete favorably with some of the largest U.S. financial institutions. Here are the biggest SBA 7(a) lenders based on the value of approved loans.

A key gauge of activity that tracks startups most likely to create jobs declined in October, potentially signaling the start of a slowdown after the rapid increase in interest rates. It presents a red flag for community banks and credit unions that are major lenders to small businesses.

Since the end of the Small Business Administration's 2022 fiscal year, the average loan size in its flagship program has dropped more than six figures. The addition of three new nondepository lenders could further drive down this figure.

But high costs and any downturn in the economy could weigh on lenders and their commercial borrowers in coming months, economists caution.

American Banker is proud to recognize the honorees for the second annual Most Powerful Women in Credit Unions.

Executives reflecting on the issues that doomed three banks say the closures stressed the importance of adapting quickly to change, and emphasized the advantages of the credit union business model.

Our annual list of The Most Powerful Women in Banking top teams.

Lisa Rickert and Ruth McCord, who manage branches for Nicolet National Bank, share a passion for connecting with their customers and supporting their communities.

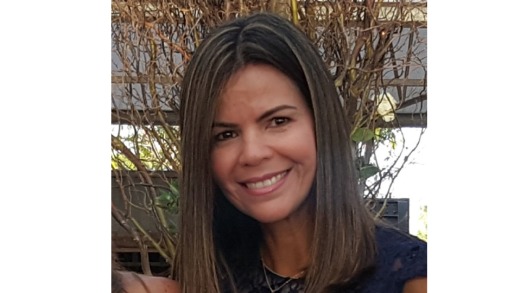

Born in Venezuela, Lolita Peroza initially came to the U.S. to further her education and improve her English. Now 20 years into her banking career, she serves as a branch manager for Amerant Bank in Florida and is described by her boss as "always looking for additional opportunities to give back to the community."

The two branches Julie Celozzi oversees for the Orlando, Florida, bank amassed $400 million of deposits in three years. Such production is often a steppingstone to bigger things, but Celozzi — who began as a part-time teller in high school — says she is "hooked" on branch banking.

Grace Law, a Hong Kong native, seized an opportunity to work in a Chase branch in New York City more than 30 years ago. Today, she seeks ways to ensure her community — immigrants who are frequently overlooked by banks — has access to financial services.

American Banker is proud to recognize, in its third annual Most Influential Women in Payments, Next, the women under 40 who have demonstrated expertise, leadership skills and an ability to adapt in an ever-changing payments industry.

In her day-to-day job directing activities at the card network's Start Path accelerator, Sabrina Tharani helps nurture companies that are developing new payments products and services.

A rising payments star — and photographer — is helping the card network reach content creators and new entrepreneurs.

The 50 companies that made American Banker's annual list share insights into what makes their workplace culture enticing for potential new hires and current staff members.

The core banking provider was No. 1 on American Banker's ranking of the Best Places to Work in Fintech this year. The company attributes this success to encouraging employees to hash out solutions to challenges.

The company has changed the dynamics of its meetings, created diversity metrics and deployed software to make job descriptions gender-neutral.

-

The Consumer Financial Protection Bureau was created to protect the people from financial predation. But there are very different interpretations of what that means, and whether the people should be protected by — or from — the government.

April 18 -

A regulatory proposal to raise bank capital has spurred banks to fight back with a populist appeal to consumers, while regulators say more capital is what's needed to save banks from more crises — and help consumers.

April 11

- Banking as a service is expensive, it takes time and onboarding has to be done carefully, says the founder of Bancorp Bank, who now runs a venture capital firm that invests in fintechs.

-

Cloud-based tech giants like Amazon, Google and Uber are changing the economy, and not for the better, asserts Yanis Varoufakis, a former finance minister of Greece and a professor at the University of Athens, who has written a book about the dangers of what he calls the "cloudalists."

April 9

-

Capital One, like Discover, is showing signs of greater stress in its loan portfolio. Credit-card write-offs totaled $2.2 billion in the first quarter, a 61% increase from a year earlier.

April 25 -

The San Francisco-based firm's Anchorage Digital Trusted Liquidity and Settlement network, better known as Atlas, will allow clients to settle a range of cryptocurrency transactions.

April 25 -

Artificial intelligence models are energy hogs. Climate First Bank and UBS are among the very few trying to solve this problem.

April 25 -

Mortgage rates rose 7 basis points this week, Freddie Mac said, and more increases are likely following a weaker than expected gross domestic product report.

April 25 -

Shares of the Raleigh, North Carolina bank, which bought Silicon Valley Bank last year, rose 7.8% on Thursday morning.

April 25