-

The Tennessee company also set high expectations for revenue opportunities while projecting it will deliver a 15% return on equity in 2019.

December 5 -

First Reliance in South Carolina, which recently announced its first bank acquisition, is angling to take advantage of disruption caused by bigger mergers in the Carolinas.

October 19 -

The company, which agreed to buy Independence Bancshares, also brought in $25 million by selling common and preferred stock.

September 26 -

Coastal FCU CEO Chuck Purvis was recognized this year by the Credit Union Executives Society for his commitment to the movement

September 21 -

The new business will advise Live Oak clients on how to structure and finance acquisitions.

September 20 -

Lynn Harton was finally named CEO of United Community Bank after a five-year apprenticeship, though Jimmy Tallent remains CEO of the parent company. The executives have long touted an ability to bounce ideas off each other as a reason for United's success.

August 17 -

The Pittsburgh company, pleased with employee and client retention from its March purchase of Yadkin Financial, is looking to hire lenders from other institutions.

July 20 -

KS Bancorp initially chided First Citizens for its aggressive moves before deciding to mull the offer over.

July 19 -

The Tennessee company reported higher profit that reflected its June purchase of BNC Bancorp and nearly $670 million of organic loan growth during the second quarter.

July 19 -

Buying Capital Bank puts the company on a fast track for more regulatory scrutiny. Executives are identifying ways to boost revenue and taking other measures so it can handle the change.

July 14 -

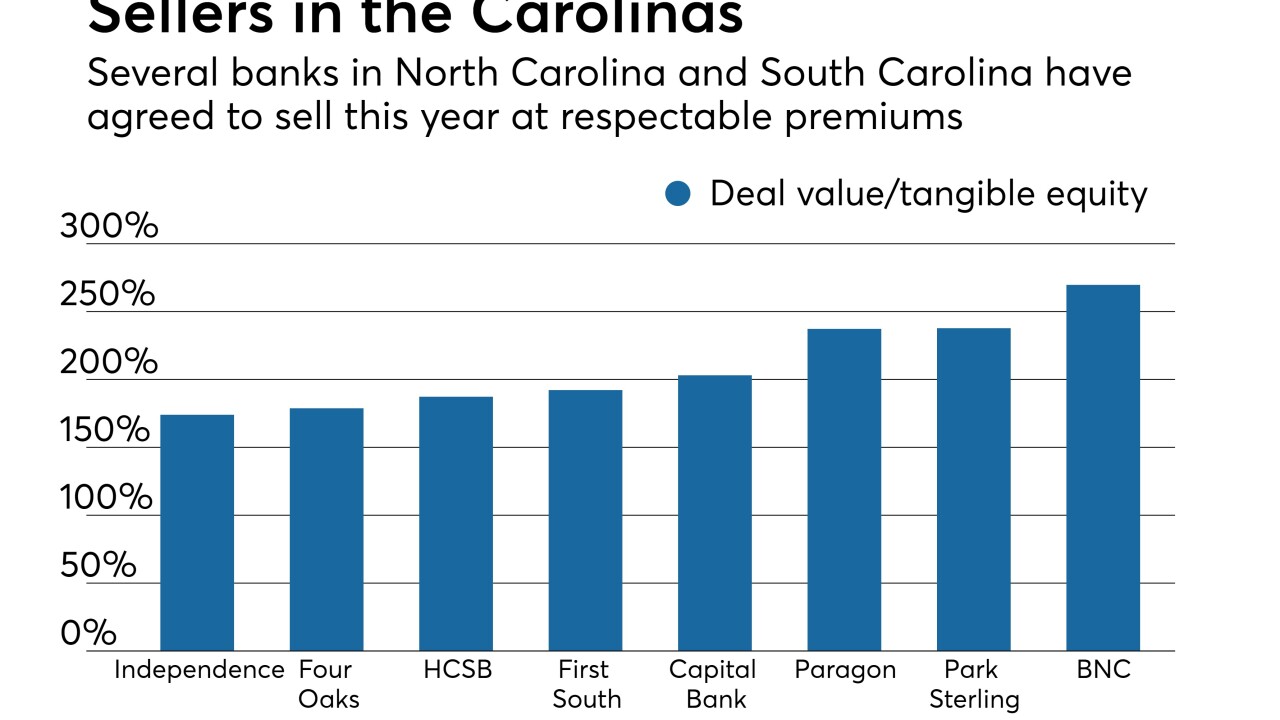

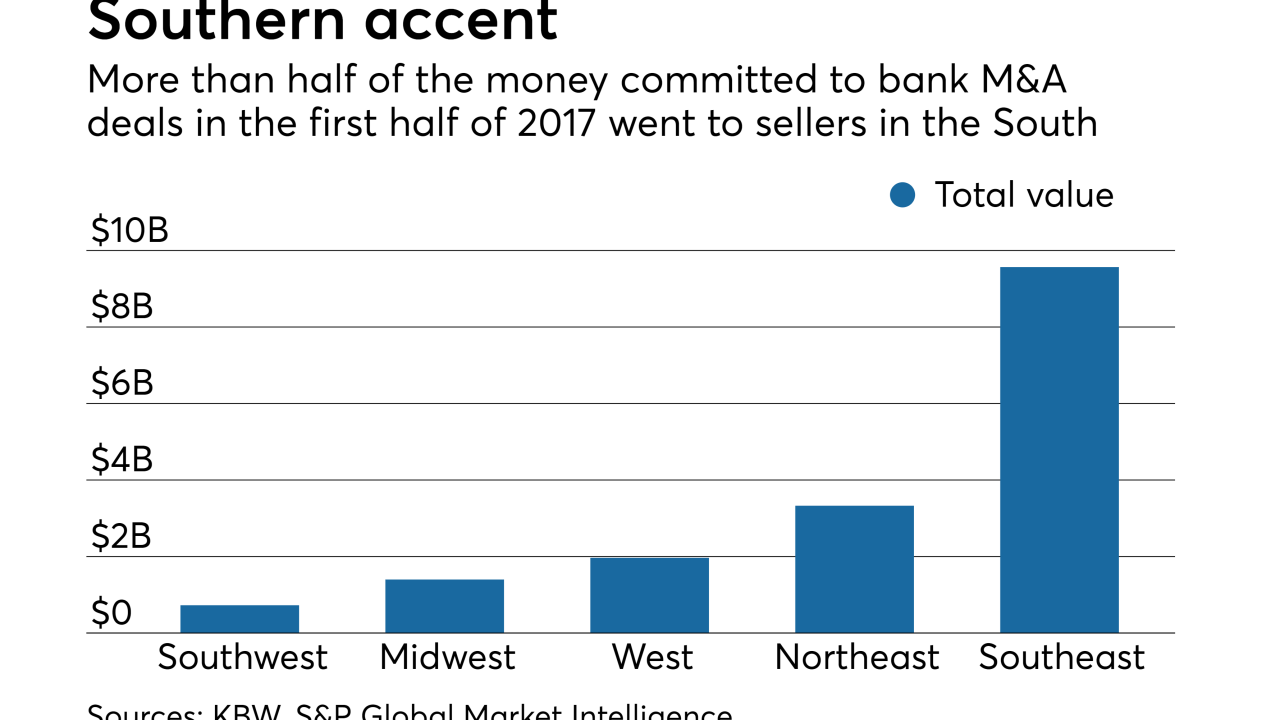

While industry consolidation remains slow compared with previous years, certain regions are humming along with strong volume and improved pricing. Here’s a look at each region based on June 30 data from KBW and S&P Global Market Intelligence.

July 14 -

AERO FCU, Truliant FCU join for debit card processing, call center support.

July 14 -

First Horizon reported lower fee income in the second quarter. The company said it is making progress planning for its pending purchase of Capital Bank Financial.

July 14 -

First Citizens is pressuring KS Bancorp to sell even though the banks' operations overlap in many markets in eastern North Carolina.

July 13 -

The North Carolina company could issue $200 million in new securities over time to fund acquisitions and other investments.

July 13 -

The region is responsible for a third of all bank sellers — and more than half of the industry's overall deal volume.

July 10 -

The North Carolina company's purchase of Chattahoochee Bank will add a branch and loan production office to its existing operations in northern Georgia.

June 28 -

The Georgia bank will pay $124 million for Four Oaks Fincorp, buying a bank with a large operation in Raleigh, N.C.

June 27 -

Pinnacle Financial Partners closed in on $20 billion in assets by buying BNC. It now has to integrate the North Carolina bank, while finding ways to boost profit and adapt to increased regulatory burden.

June 16 -

Having managed five credit unions even while serving as CEO of one, the 92-year-old is believed to have set a record for length of service.

June 16