In a speech Tuesday, Federal Reserve Gov. Michael Barr said it was possible that artificial intelligence will boost productivity in an undisruptive way. But he said policymakers should also be wary of a financial crash if those gains are not realized or a rapid adoption that could lead to labor displacement.

Some traditional bankers are unsettled by the wave of crypto and fintech banks getting bank charters. This Nashville bank CEO sees opportunity.

-

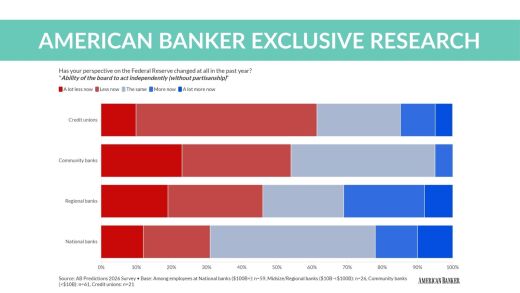

The Federal Reserve is moving quickly to implement its proposed "skinny" master account, giving state-chartered fintechs more access to the central bank's payment systems. But experts say a legal challenge to the rule is almost certain, regardless of where the Fed draws the line.

-

Affordability concerns are driving consumer demand for short-term liquidity products like earned wage access. A similar, credit union-backed lending alternative is gaining popularity as a way to amass new customers and, for banks, CRA credit.

-

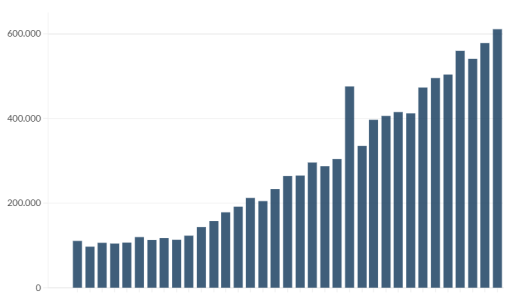

The ACH Network reached new highs in 2025 as both traditional and same-day ACH usage grew at healthy clips. The trend could negatively impact deposits and cards.

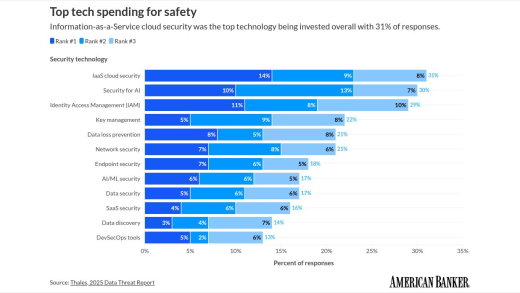

Research from American Banker finds that executives are under pressure from nonbank firms and are concerned about identity theft in 2026.

First National Corp. in Virginia announced the sale of its two North Carolina branches. Meanwhile, a number of larger competitors are laying plans for growth in the Carolinas.

Federal Reserve Vice Chair for Supervision Michelle Bowman said in a speech Monday morning that the central bank will introduce two capital proposals that she said are aimed at boosting banks' role in the mortgage market.

-

As artificial intelligence increasingly plays a role in the regulation of banks and other financial services firms, regulators need to be certain that these new systems aren't importing old biases into modern oversight.

-

Financial fraud in the U.S. has become so sophisticated that it now has its own internal economy, complete with supply chains and customer service. Banks need to wake up to the reality that the landscape has changed.

-

Policymakers in Washington have rarely been as aligned with the banking industry as they will be for the next year or two. Bankers should use this time to expand and fortify their businesses for the future.

-

New York Attorney General Letitia James warns that scammers are coaching victims to bypass bank security and using "second act" schemes to steal more.

-

JPMorganChase, Citi, Vantage Bank and Custodia Bank have all chosen Ethereum as the underpinning for blockchain projects such as tokenized deposits. The chairman of the Enterprise Ethereum Alliance explains the OG blockchain.

-

The path of US interest rates remains in focus following the slower-than-expected US inflation print as traders fully price a Fed cut in July.

-

After losing nearly $700 million in the fourth quarter as bitcoin's valuation tanked, Brian Armstrong stressed product diversification will help the company navigate the downturn.

-

Rich Guerrini said the bank plans to expand its advisor ranks by about 50% as it targets mass affluent and other new clients with personalized branch-based service.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The annual rankings honor the notable performances of individuals in banking and finance and as teams.

Call for submissions for women 40 years and younger who are rising leaders at their bank or financial institution.

The 23rd annual ranking of women leaders in the banking industry.

-

-

- Partner Insights from Finzly

- Sponsor Content from Outsystems