-

The company will also gain $260 million in loans and $180 million in deposits from Banner Corp.

July 27 -

The company has agreed to buy Puget Sound Bancorp to expand in a competitive, fast-growth market.

July 27 -

The Texas company would add seven branches and more than $300 million of assets by acquiring Valley Bancorp.

July 26 -

First Financial in Ohio is buying MainSource in Indiana — with a twist. MainSource's leader will become CEO.

July 26 -

The company agreed to buy MainSource Financial in Indiana for $1 billion, creating a Midwestern bank that will have more than 200 branches and $13 billion in assets.

July 26 -

The New Jersey bank is looking to raise offensive capital just months after its deal to be sold to Investors Bancorp was terminated. Investors was tripped up by regulatory concerns tied to Bank Secrecy Act and anti-money-laundering compliance.

July 24 -

Delmar will buy Liberty Bell Bank in New Jersey, which had survived a debilitating six-year battle for control with a former CEO. Liberty Bell also suffered from corporate theft and a check-kiting scandal.

July 24 -

The $482 million deal would be Associated's first bank acquisition since June 2007.

July 20 -

The company will add two branches between Denver and Colorado Springs by buying the deposit-rich Castle Rock Bank.

July 20 -

First Home Bank raised nearly 20% more than it sought from investors, providing proof that Florida — especially the Tampa Bay area — is a hotbed of activity.

July 19 -

The company will gain more than $500 million in assets after buying Eastman National and Cache Holdings.

July 17 -

Several RBB Bancorp executives and directors, including CEO Alan Thian, will also sell a significant number of shares when the Los Angeles company goes public.

July 14 -

As NCUA continues work on creating another avenue for building capital, credit unions need to bone up on what the different terms mean and the potential impact.

July 14 CUNA Mutual Group

CUNA Mutual Group -

Readers slam credit unions’ ever-inclusive membership criteria, weigh in on the OCC’s proposed fintech charter, encourage a rewrite of the CRA, and more.

July 14 -

First Citizens is pressuring KS Bancorp to sell even though the banks' operations overlap in many markets in eastern North Carolina.

July 13 -

The North Carolina company could issue $200 million in new securities over time to fund acquisitions and other investments.

July 13 -

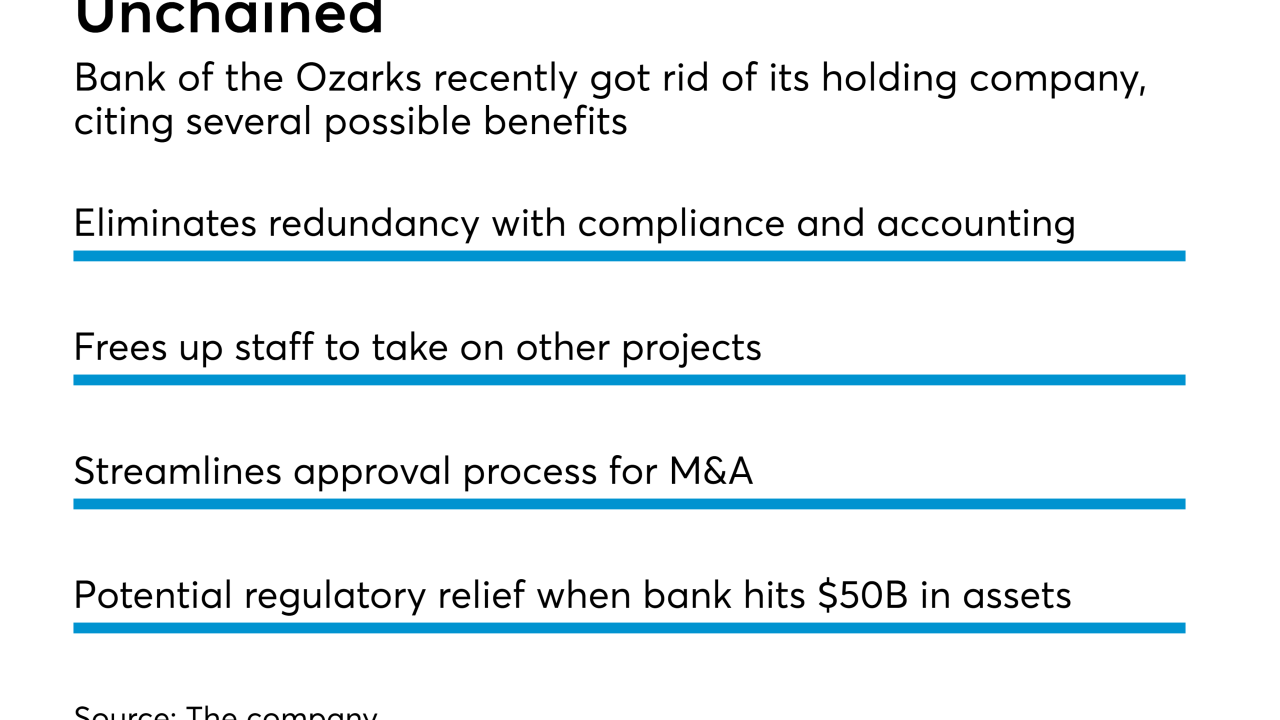

Bank of the Ozarks recently dissolved its holding company in a move that goes against modern banking strategy. There are, however, strong arguments for other institutions to follow the bank's lead.

July 12 -

The Treasury Department will take a huge hit when Cecil Bancorp sells its bank, while 1st Mariner Bank in Baltimore will see its equity stake completely wiped out. Cecil opted for bankruptcy court when it was unable to resolve an impasse over its trust-preferred stock.

July 11 -

The subprime business lender halted new business and laid off scores of employees after recording higher-than-expected losses.

July 6 -

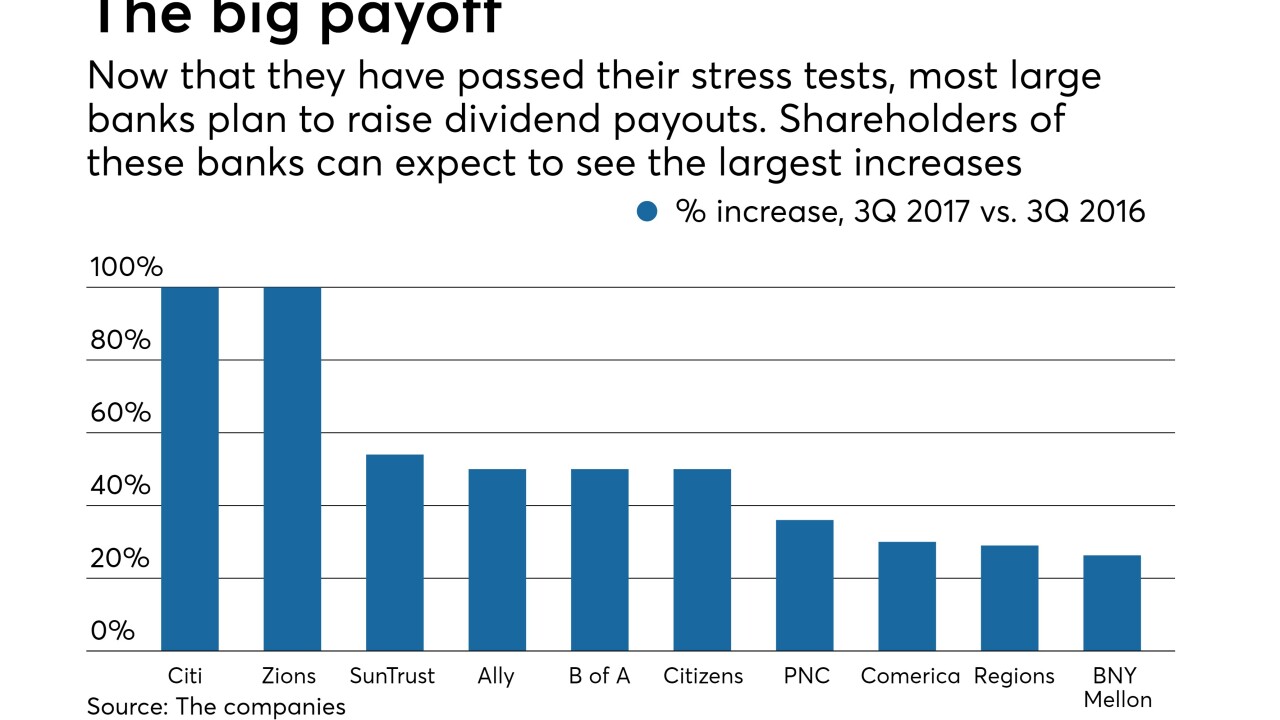

Higher dividends and more aggressive repurchase programs are bound to attract more investors, which could boost stock prices and prompt more dealmaking, analysts said.

June 29