-

The Consumer Financial Protection Bureau's unblemished track record regarding enforcement actions came to an end in 2016 as more companies began fighting back.

March 31 -

Merchants storing and batch processing payments offline in the U.K. are opening the door for fraudsters to potentially use contactless cards that have been reported lost or stolen for several months after a bank cancels them.

March 31 -

A full changeout of AML and KYC rules would stress compliance. Working to improve current practices would be better for the financial services and payments industries.

March 31 NTT Data Consulting

NTT Data Consulting -

Data and analytics tools can help banks and credit unions detect financial patterns that may indicate that human trafficking is occurring.

March 30 -

With scammers steadily improving their techniques, CO-OP Financial Services is starting to offer artificial intelligence to police transactions initiated by online, mobile and other connected devices.

March 30 -

Low scores make it harder for banks to get regulatory OKs to expand, but Wells is in retrenchment mode anyway.

March 29 -

Data and analytics tools can help banks detect financial patterns that may indicate that human trafficking is occurring.

March 29 -

Mastercard has added another layer to its security for the evolving Internet of Things (IoT) with the acquisition of NuData, a Vancouver, Canada-based company whose technology analyzes biometric and behavioral patterns.

March 29 -

The settlement, which requires judicial approval, will cover customers' fees and other costs related to about 2 million unauthorized accounts.

March 28 -

As online lenders and their vendors step up monitoring, patterns of fraud are emerging.

March 28 -

A group of 10 Republican senators are calling on Treasury Secretary Steven Mnuchin to drop the government’s appeal of a ruling last year that rejected MetLife’s designation as a systemically risky firm and to de-designate the remaining two SIFI nonbanks.

March 28 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

March 24 -

The Justice Department believes that Pyongyang was behind last year's New York Fed heist; Marcus Schenck, DB's CFO and deputy CEO, may be next in line to head the big German bank.

March 23 -

Community banks, which could be the hardest hit if economic tensions between the U.S. and Mexico escalate into a tariff battle, are urging policymakers to refrain from rash action, and big banks are already trimming exposures.

March 22 -

Retail-focused Provident Bank has added an on/off switch that allows customers to suspend their debit cards. A few big banks rolled out similar features last year.

March 22 -

Retail-focused Provident Bank has added an on/off switch that allows customers to suspend their debit cards. A few big banks rolled out similar features last year.

March 21 -

Cash that flowed from Russia through a vast money-laundering network sometimes ended up passing through the world's largest banks, including Citigroup, Bank of America, and HSBC, the Guardian reported, citing a cache of financial records it reviewed.

March 20 -

The latest numbers underscore the extent of the challenge that the megabank faces in restoring its once-clean public image.

March 20 - Finance and investment-related court cases

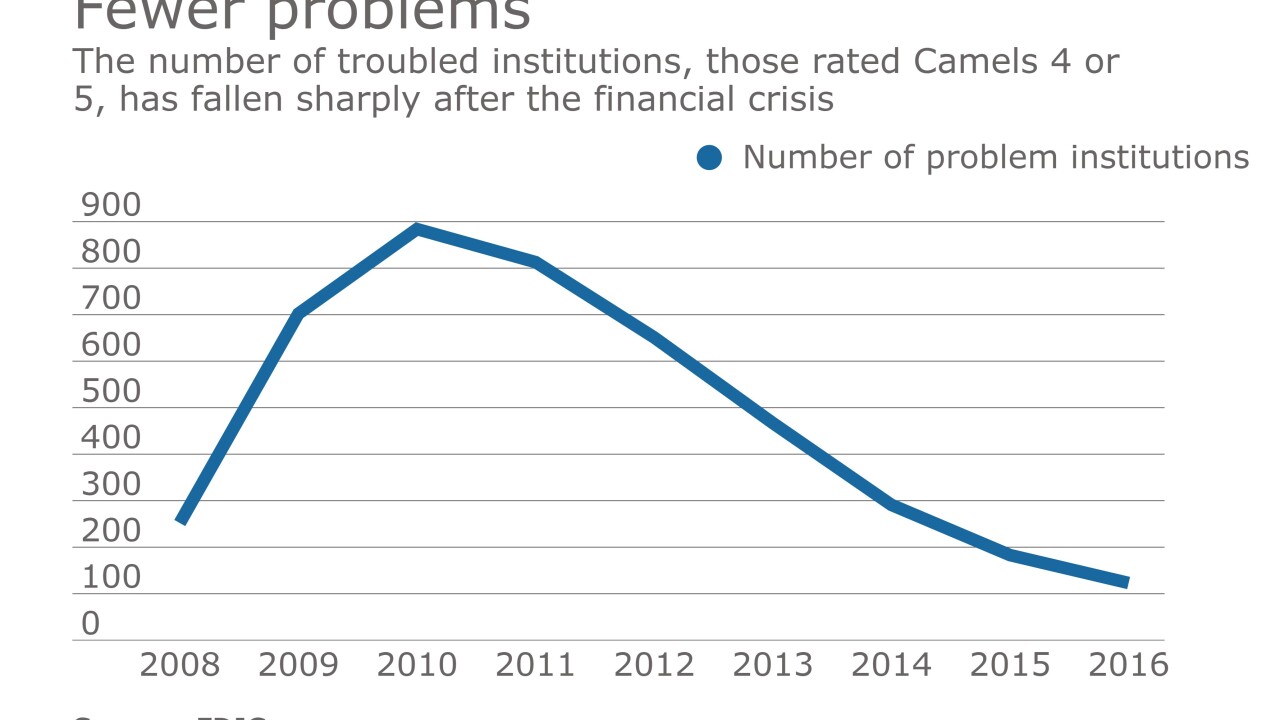

A bank took the unusual step of suing the FDIC over its Camels rating of 4 in a case that could set an important precedent for the industry.

March 20 -

The Justice Department told a federal appeals court on Friday that President Trump should have the authority to fire the head of the Consumer Financial Protection Bureau.

March 17